In the competitive world of luxury brands, finding the balance between exclusivity and affordability can be a complex task. European luxury brands, known for their heritage, craftsmanship, and high standards, often come with hefty price tags. However, among these high-end names, some brands stand out for offering a relatively more affordable luxury experience.

When discussing affordability in luxury brands, it’s essential to define what we mean by “affordable.” In this context, we consider a brand affordable if it offers products that, while still high-end and luxurious, are priced lower than their competitors. Among European luxury brands, Coach, while American, has strong ties and design inspirations from Europe, offering a more accessible price point. Yet, within purely European brands, Michael Kors, based in London and Paris, often stands out.

The affordability of Michael Kors is reflected in its pricing strategy. While brands like Louis Vuitton, Chanel, and Gucci often have entry-level products starting at $1,000 or more, Michael Kors offers luxury handbags starting around $300 to $500. This price difference is significant for consumers looking to enter the luxury market without a significant financial commitment.

Trends in the luxury market reveal several factors driving the affordability of certain brands. One trend is the increasing demand for “accessible luxury,” where consumers seek high-quality products without the traditional luxury price tag. This demand has been particularly evident among younger consumers, such as Millennials and Generation Z, who value experiences and quality over brand prestige alone. Michael Kors has successfully tapped into this trend by offering stylish, high-quality products at more approachable prices.

Another trend is the rise of e-commerce and digital marketing, which have allowed brands like Michael Kors to reach a broader audience. By leveraging online platforms, these brands can reduce overhead costs associated with physical stores and pass those savings onto consumers. Additionally, collaborations with influencers and celebrities have helped Michael Kors maintain a trendy and desirable image while keeping prices relatively low.

The impact of affordable luxury brands on the global market is multifaceted. Firstly, it has expanded the consumer base for luxury products. Traditional luxury brands often cater to a small, wealthy demographic. In contrast, more affordable luxury brands can reach middle-class consumers who aspire to own high-end products. This democratization of luxury has increased the overall market size. According to a report by Bain & Company, the global personal luxury goods market was valued at approximately €281 billion in 2019 and is projected to continue growing, driven in part by accessible luxury brands.

For the general world customer market, the availability of affordable luxury brands like Michael Kors has provided more choices. Consumers no longer have to choose between fast fashion and ultra-high-end luxury. They can opt for something in between, combining quality, style, and a sense of exclusivity without breaking the bank. This shift has also pressured traditional luxury brands to reassess their pricing strategies and product offerings.

In recent years, the influence of affordable luxury brands has been evident in their financial performance and market presence. Michael Kors, for instance, has shown strong revenue growth and market penetration. In the fiscal year 2021, Capri Holdings Limited, the parent company of Michael Kors, reported revenues of $4.06 billion, demonstrating the brand’s strong market position. Additionally, Michael Kors’ expansion into new markets, particularly in Asia, has further solidified its status as a global player in the luxury sector.

With consumers becoming more conscious of the environmental and social impacts of their purchases, brands like Michael Kors have taken steps to address these concerns. By incorporating sustainable materials and ethical manufacturing practices, these brands not only appeal to a broader audience but also contribute positively to their brand image and the industry’s overall sustainability efforts.

Recent events and stories further highlight the relevance of affordable luxury brands. For instance, the COVID-19 pandemic has significantly impacted consumer behavior and spending patterns. With economic uncertainty and changing lifestyles, many consumers have become more cautious with their spending. Affordable luxury brands, offering a blend of luxury and value, have become attractive options for those who still desire quality and style but are mindful of their budgets.

Moreover, the rise of social media and digital platforms has allowed affordable luxury brands to engage directly with their audience. Michael Kors, for example, has leveraged platforms like Instagram and TikTok to showcase its products, collaborate with influencers, and create a sense of community among its customers. This direct engagement has strengthened brand loyalty and increased visibility among younger, tech-savvy consumers.

Among European luxury brands, Michael Kors stands out as one of the most affordable, offering high-quality products at prices significantly lower than its competitors. This affordability is driven by trends such as the demand for accessible luxury, the rise of e-commerce, and strategic digital marketing. The impact of affordable luxury brands on the global market is substantial, expanding the consumer base, increasing market size, and pressuring traditional luxury brands to adapt. For the general world customer market, these brands provide more choices and accessibility to luxury products. As consumer preferences continue to evolve, the success of affordable luxury brands like Michael Kors is likely to persist, shaping the future of the luxury market in a positive and inclusive direction.

How Michael Kors can be a choice for the entry level of luxury world for the enthusiast?

Michael Kors has carved out a distinctive niche in the world of fashion, serving as an ideal entry point for luxury enthusiasts. With a blend of accessible pricing, stylish designs, and strategic brand positioning, Michael Kors appeals to those taking their first steps into the luxury market.

Michael Kors, founded by the American designer of the same name, began as a sportswear line in 1981 and has since evolved into a globally recognized luxury fashion house. The brand’s approachability stems from its ability to balance high-end appeal with affordability. This balance is crucial for consumers transitioning from mainstream brands to luxury goods. Michael Kors’ product range, including handbags, watches, footwear, and ready-to-wear apparel, offers an accessible price point compared to high-end luxury brands like Chanel or Louis Vuitton, making it an attractive option for aspiring luxury consumers.

One of the key trends propelling Michael Kors into the limelight as an entry-level luxury brand is the growing desire for affordable luxury. As the global middle class expands, so does the demand for luxury goods that don’t break the bank. According to a report by Bain & Company, the global luxury market was valued at approximately €1.1 trillion in 2022, with the personal luxury goods segment, including fashion and accessories, growing by 5% annually. Michael Kors leverages this trend by positioning itself within the “accessible luxury” category, offering products that provide a taste of luxury without the hefty price tag.

Michael Kors’ strategic market positioning is further bolstered by its ability to tap into the aspirations of younger consumers. Millennials and Generation Z, who now account for a significant portion of luxury consumption, are drawn to brands that combine style, quality, and value. A survey by Deloitte found that 60% of Millennials prioritize affordability when purchasing luxury items, making Michael Kors an appealing choice. The brand’s marketing strategies, including collaborations with influencers and social media campaigns, resonate well with these tech-savvy consumers, enhancing its appeal as a modern, trendy luxury brand.

Another significant factor contributing to Michael Kors’ appeal is its robust presence in the global market. The brand operates over 1,200 retail stores worldwide and has a strong e-commerce platform, making its products easily accessible to a broad audience. In 2023, Michael Kors reported global revenue of approximately $5 billion, reflecting its extensive reach and popularity. The brand’s international expansion strategy, including entering emerging markets like China and India, has been instrumental in capturing a diverse customer base seeking affordable luxury.

The impact of Michael Kors on the global market is multifaceted. For one, it challenges the traditional notion that luxury must come at a premium price. By offering stylish, high-quality products at more accessible prices, Michael Kors democratizes luxury, making it attainable for a wider audience. This approach disrupts the luxury market, compelling other brands to reassess their pricing strategies and product offerings.

In addition, Michael Kors’ success has implications for the general world customer market. As more consumers experience the brand, they develop a taste for luxury, potentially leading to increased spending on higher-end luxury items in the future. This phenomenon, known as “trading up,” suggests that entry-level luxury brands like Michael Kors serve as stepping stones, gradually introducing consumers to the world of high fashion. According to a study by McKinsey & Company, 78% of luxury consumers started with accessible luxury brands before moving on to more prestigious labels.

Michael Kors also plays a pivotal role in setting trends within the luxury market. The brand’s ability to swiftly adapt to changing fashion trends while maintaining its signature aesthetic ensures its relevance. For instance, Michael Kors’ embrace of athleisure, a trend characterized by stylish yet comfortable clothing, has resonated with consumers seeking fashionable yet functional attire. This adaptability not only attracts a broad customer base but also influences other luxury brands to innovate and stay competitive.

The brand’s influence extends to recent events and collaborations that have captured public attention. Michael Kors’ partnership with supermodel Bella Hadid for the Watch Hunger Stop campaign, aimed at combating global hunger, highlights the brand’s commitment to social responsibility. Such initiatives enhance the brand’s image, appealing to socially conscious consumers who value ethical and sustainable practices. Additionally, Michael Kors’ collaboration with popular influencers and celebrities amplifies its reach and reinforces its position as a trendy, accessible luxury brand.

Moreover, Michael Kors’ success underscores the importance of digital innovation in the luxury market. The brand’s investment in e-commerce and digital marketing has paid off, particularly during the COVID-19 pandemic when online shopping surged. In 2022, Michael Kors reported a 30% increase in online sales, highlighting the significance of a robust digital presence. By leveraging technology, Michael Kors meets the evolving preferences of consumers who increasingly seek convenience and personalized shopping experiences.

Michael Kors emerges as an ideal choice for enthusiasts entering the luxury market due to its strategic positioning, affordability, and ability to adapt to trends. The brand’s success reflects broader market dynamics, including the rise of accessible luxury and the growing influence of younger, tech-savvy consumers. Michael Kors’ impact on the global market is profound, democratizing luxury and setting trends that shape the industry. As the brand continues to innovate and expand its global footprint, it remains a compelling entry point for consumers aspiring to experience the world of luxury.

What is actually the meaning of accessible luxury?

Accessible luxury is a term that has redefined the luxury market, transforming the way consumers perceive and purchase high-end products. Traditionally, luxury was synonymous with exclusivity, opulence, and a high price tag. It was a realm reserved for the affluent, where products were more about status symbols than functionality or accessibility. However, the concept of accessible luxury has bridged the gap between exclusivity and affordability, making luxury attainable for a broader audience without compromising on quality or prestige. This shift has not only altered consumer behavior but has also had a profound impact on the global market.

The rise of accessible luxury can be attributed to the growing middle class and their increasing purchasing power. By offering products at lower price points, they have managed to attract a new demographic without diluting their brand image. The global luxury market, valued at approximately $322 billion in 2023, has seen accessible luxury products accounting for a significant portion of this growth. Brands like Michael Kors, Coach, and Tory Burch have led this segment, offering products that exude luxury at more attainable prices. For example, Michael Kors reported a 12% increase in revenue in 2022, largely driven by their accessible luxury lines.

The concept of accessible luxury is not confined to the fashion industry. It spans across various sectors including automotive, beauty, and technology. In the automotive industry, brands like Tesla have redefined luxury with their more affordable Model 3. Priced significantly lower than traditional luxury cars, the Model 3 has made luxury electric vehicles accessible to a broader market. In 2022, Tesla’s sales surged by 40%, highlighting the demand for accessible luxury vehicles. Similarly, in the beauty industry, brands like Fenty Beauty by Rihanna have democratized luxury cosmetics. Launched in 2017, Fenty Beauty generated $570 million in revenue within 15 months, thanks to its inclusive range of products at mid-tier price points.

Millennials and Gen Z, who prioritize experiences over possessions but still seek quality and status, are particularly drawn to accessible luxury. These generations are tech-savvy, value-driven, and heavily influenced by social media. A 2022 study by Bain & Company revealed that millennials and Gen Z accounted for 60% of the luxury market’s growth. Social media platforms play a crucial role in this trend, with Instagram and TikTok being major influencers. Brands collaborate with influencers to promote their accessible luxury products, creating aspirational yet attainable images that resonate with younger consumers. This strategic use of social media has amplified the reach and appeal of accessible luxury, making it a significant trend in the global market.

One of the most significant impacts of accessible luxury on the world market is the democratization of high-quality products. This trend has led to increased competition, pushing brands to innovate and maintain quality while managing costs. For consumers, this means more choices and better value for money. However, it also poses challenges for traditional luxury brands, which must balance exclusivity with accessibility. Brands like Louis Vuitton and Gucci have successfully navigated this by introducing entry-level products without compromising their high-end lines. This balance allows them to cater to a broader audience while maintaining their prestigious image.

Economically, accessible luxury has substantial implications. By broadening their consumer base, luxury brands contribute to economic growth through job creation, increased production, and higher sales. The expansion of accessible luxury brands in emerging markets like China and India has led to robust economic activities in these regions. In 2022, China accounted for 35% of the global luxury market, with a significant portion coming from accessible luxury products. This trend indicates a shift in the economic landscape, where emerging markets play a pivotal role in driving the luxury market.

Consumer behavior has also evolved with the rise of accessible luxury, shifting the focus from conspicuous consumption to value-driven purchases. Consumers are more informed and discerning, seeking products that offer a blend of quality, design, and affordability. This shift is evident in the rise of resale platforms like The RealReal and Vestiaire Collective, where consumers buy and sell pre-owned luxury items. In 2021, The RealReal reported $468 million in gross merchandise value, indicating a growing acceptance of sustainable luxury consumption. This trend towards sustainability is becoming increasingly important, with consumers demanding transparency and ethical practices from brands.

Marketing strategies have adapted to the accessible luxury trend, with brands adopting digital-first approaches. Leveraging data analytics and artificial intelligence, they understand consumer preferences and tailor their offerings accordingly. E-commerce has become a vital channel for accessible luxury, with online sales accounting for 23% of the total luxury market in 2022. Brands like Burberry and Chanel have invested heavily in digital transformation, offering personalized shopping experiences and seamless omnichannel integration. This digital shift has not only enhanced customer engagement but has also streamlined operations, making luxury more accessible.

However, the rise of accessible luxury is not without challenges. Brands must ensure they do not erode their prestige by becoming too commonplace. Maintaining a balance between accessibility and exclusivity is crucial. Additionally, sustainability concerns are increasingly important to consumers. Brands must address these issues by adopting sustainable practices and transparent supply chains. For instance, Stella McCartney has been a pioneer in sustainable luxury, promoting eco-friendly materials and ethical production methods. This commitment to sustainability not only aligns with consumer values but also sets a benchmark for the industry.

Accessible luxury redefines the traditional boundaries of luxury, making it attainable for a wider audience while maintaining its premium appeal. This trend has significant implications for the global market, driving economic growth, influencing consumer behavior, and reshaping marketing strategies. Brands that successfully navigate this landscape can tap into a lucrative market, but they must balance accessibility with exclusivity and address sustainability concerns. As the world continues to evolve, accessible luxury will remain a dynamic and influential force in the global economy. The democratization of luxury is not just a trend; it is a reflection of changing consumer aspirations and economic realities, promising a future where luxury is within reach for many, not just a privileged few.

How important luxury brand are also keep creating a product line that embrace entry level of luxury?

In the realm of luxury brands, there is an ever-present allure that captivates consumers worldwide. However, as the market evolves, a notable trend has emerged: the development of entry-level luxury products. This strategy is not only a reflection of changing consumer preferences but also a critical move for luxury brands aiming to sustain their market relevance and expand their customer base. The significance of luxury brands embracing entry-level luxury products is multifaceted, influencing the global market, consumer behavior, and brand dynamics.

The trend of luxury brands creating entry-level product lines can be traced back to a broader strategy aimed at democratizing luxury. Historically, luxury brands such as Louis Vuitton, Gucci, and Chanel have catered to a niche market segment, often characterized by high net worth individuals. However, as the global middle class expands and disposable incomes rise, there is a growing appetite for luxury experiences among a broader consumer base. According to a McKinsey report, the global luxury market is projected to grow from €281 billion in 2019 to €320-330 billion by 2025, driven by increased demand from younger consumers and emerging markets.

This shift has prompted luxury brands to rethink their product offerings. By introducing entry-level luxury items, brands can tap into a wider audience without diluting their exclusivity. For instance, Gucci’s introduction of its GG Marmont mini bag, priced significantly lower than its traditional handbags, has attracted younger, aspirational consumers who seek the prestige associated with the brand but at a more accessible price point. Similarly, brands like Burberry and Prada have launched product lines that include accessories, perfumes, and small leather goods, which serve as entry points for new customers.

The impact of this trend on the global market is substantial. Entry-level luxury products have expanded the overall market size, creating new revenue streams for luxury brands. Bain & Company estimates that millennials and Gen Z will account for over 50% of the total luxury market by 2025. These younger consumers are characterized by their desire for unique and authentic experiences, often seeking brands that resonate with their personal values and lifestyle. By offering entry-level luxury products, brands can engage with this demographic early, fostering brand loyalty and encouraging future purchases of higher-end items as their purchasing power grows.

From a global customer market perspective, the appeal of entry-level luxury products is evident. These products provide an opportunity for consumers to experience luxury without the prohibitive price tag. This accessibility is particularly relevant in emerging markets such as China, India, and Southeast Asia, where the middle class is burgeoning. In China alone, the number of middle-class households is expected to reach 550 million by 2025, representing a significant market for luxury brands. By offering entry-level products, brands can capture the attention of these consumers, who may eventually transition to higher-end products as their incomes increase.

The introduction of entry-level luxury products also aligns with broader consumer trends. Today’s consumers are more informed and discerning, with access to a wealth of information about brands and products through digital platforms. They seek value, not just in terms of price, but also in quality, craftsmanship, and brand heritage. Luxury brands that can convey these attributes through their entry-level products are more likely to succeed in this competitive landscape. For example, the success of Tiffany & Co.’s return to iconic, yet affordable, jewelry pieces like the Tiffany T collection has reinforced the brand’s commitment to quality and timeless design, appealing to a new generation of customers.

Moreover, the rise of social media and digital marketing has played a pivotal role in the success of entry-level luxury products. Platforms such as Instagram, TikTok, and WeChat enable brands to reach a global audience, showcasing their products and engaging with consumers in real-time. Influencer marketing and collaborations with celebrities and fashion icons have further amplified the appeal of entry-level luxury items. For instance, collaborations like Louis Vuitton x Supreme have generated significant buzz and driven sales among younger consumers, highlighting the power of digital platforms in shaping consumer preferences and driving market trends.

The strategic move towards entry-level luxury products also reflects a response to economic uncertainties and shifting consumer priorities. The COVID-19 pandemic, for instance, has altered consumer behavior, with many individuals prioritizing savings and value-driven purchases. In this context, entry-level luxury products offer a compromise, allowing consumers to indulge in luxury without excessive expenditure. This approach not only addresses immediate market conditions but also positions brands favorably for long-term growth.

However, the introduction of entry-level products is not without challenges. Luxury brands must carefully balance accessibility with exclusivity to maintain their brand prestige. Over-expansion into entry-level categories can risk diluting the brand’s perceived value. Therefore, it is crucial for brands to maintain a clear distinction between their entry-level and high-end products, ensuring that the former serves as a gateway rather than a substitute for the latter.

The importance of luxury brands embracing entry-level luxury products cannot be overstated. This trend reflects a strategic adaptation to changing market dynamics, expanding consumer bases, and evolving consumer preferences. By offering accessible luxury experiences, brands can engage with a broader audience, drive revenue growth, and build long-term brand loyalty. The success of this approach is evident in the performance of leading luxury brands and their ability to navigate the complexities of a dynamic global market. As the luxury landscape continues to evolve, the integration of entry-level products will remain a critical component of brand strategy, shaping the future of luxury consumption worldwide.

How gen z and millenials are into accessible luxury in recent time?

The intersection of Generation Z and Millennials with the concept of accessible luxury has become a defining trend in recent times. This phenomenon is reshaping markets, influencing consumer behavior, and compelling luxury brands to adapt their strategies to meet the demands of these influential demographics.

The allure of luxury has always been strong, yet traditionally, it was a privilege reserved for the affluent. However, Generation Z and Millennials are driving a paradigm shift by seeking luxury that is not only aspirational but also attainable. This pursuit of accessible luxury reflects a broader desire for quality, authenticity, and exclusivity, without the prohibitive price tags historically associated with high-end products. The rise of accessible luxury is fueled by several factors, including increased disposable income, changing cultural values, and the democratization of luxury through technology and social media.

One of the most significant drivers of this trend is the increasing purchasing power of Millennials and Generation Z. According to a study by Deloitte, Millennials are projected to spend $1.4 trillion annually in the U.S. alone, while Generation Z is expected to account for 40% of global consumers by 2025. This substantial economic influence has prompted luxury brands to cater to these demographics by offering more affordable, yet still premium, product lines. For instance, brands like Gucci, Balenciaga, and Louis Vuitton have introduced accessible collections that maintain their luxurious appeal but come at lower price points.

Social media plays a crucial role in the proliferation of accessible luxury. Platforms like Instagram, TikTok, and Pinterest provide a virtual storefront for luxury brands, allowing them to reach a wider audience and create aspirational content that resonates with younger consumers. Influencer marketing, in particular, has become a powerful tool in this regard. Influencers, who often personify the blend of luxury and attainability, can sway consumer preferences and drive sales. A notable example is the collaboration between Gucci and the popular TikTok star, Lil Huddy, which generated significant buzz and increased brand visibility among Gen Z.

Technology has also democratized luxury through e-commerce and online marketplaces. Websites like Farfetch, Net-a-Porter, and The RealReal offer a curated selection of luxury goods at various price points, making it easier for younger consumers to access and purchase high-end products. Furthermore, the rise of direct-to-consumer (DTC) brands has disrupted traditional retail models, allowing companies to offer luxury products at lower prices by cutting out intermediaries. Brands like Everlane and Warby Parker exemplify this approach, providing high-quality, stylish products directly to consumers.

The impact of accessible luxury on the global market is profound. According to Bain & Company’s Luxury Goods Worldwide Market Study, the global luxury market reached €281 billion in 2021, with accessible luxury contributing significantly to this growth. The study highlights that the shift towards more affordable luxury items has expanded the customer base, attracting younger and more diverse consumers. This democratization of luxury is not only boosting sales but also fostering brand loyalty among a new generation of shoppers.

In the broader consumer market, the trend of accessible luxury is influencing purchasing behaviors and expectations. Younger consumers prioritize experiences and values over mere product ownership. They seek brands that align with their principles, such as sustainability, ethical production, and social responsibility. This shift is evident in the rise of sustainable luxury brands like Stella McCartney and Veja, which emphasize eco-friendly practices and transparency. As a result, traditional luxury brands are also adopting more sustainable practices to stay relevant and appealing to these conscious consumers.

The blending of luxury and accessibility has also led to the rise of the “masstige” market, a term coined to describe mass-market brands that incorporate elements of prestige and luxury. Companies like Apple and Tesla exemplify this trend, offering products that combine high-quality design and performance with broader accessibility. Apple’s iPhone, for instance, is a status symbol that is relatively affordable compared to traditional luxury items, while Tesla’s electric vehicles offer cutting-edge technology and a premium driving experience at competitive prices.

Recent events and trends further illustrate the dynamic nature of accessible luxury. The COVID-19 pandemic, for instance, accelerated the shift towards e-commerce and digital engagement. With physical stores closing and travel restrictions in place, luxury brands had to pivot to online platforms to maintain customer engagement and sales. Virtual fashion shows, digital fittings, and augmented reality (AR) experiences became essential tools for brands to showcase their products and connect with consumers. This digital transformation has made luxury more accessible and interactive, appealing to tech-savvy Gen Z and Millennials.

Additionally, the rise of the resale market has made luxury even more attainable. Platforms like Depop, Poshmark, and Vestiaire Collective allow consumers to buy and sell pre-owned luxury goods at lower prices. This trend not only offers affordability but also promotes sustainability by extending the lifecycle of luxury items. According to a report by ThredUp, the resale market is projected to reach $77 billion by 2025, driven largely by younger consumers seeking both value and eco-consciousness.

The trend of accessible luxury among Generation Z and Millennials is reshaping the luxury market and influencing consumer behavior worldwide. This shift is driven by the increased purchasing power of younger generations, the democratization of luxury through technology and social media, and the growing emphasis on sustainability and values. The impact is evident in the expanding market size, changing brand strategies, and the rise of the masstige segment. As accessible luxury continues to evolve, it will play a pivotal role in defining the future of the global luxury market, offering a blend of exclusivity and attainability that resonates with the aspirations of modern consumers.

How important price point in luxury world?

In the world of luxury goods, price point plays a crucial role in defining a brand’s identity and positioning in the market. Luxury is synonymous with exclusivity, and pricing is a key element that helps maintain this exclusivity. Brands like Louis Vuitton, Chanel, and Rolex leverage their high price points to create a sense of rarity and desirability. The higher the price, the more exclusive the product seems, which in turn attracts a specific segment of consumers willing to pay a premium for the perceived value and status that comes with it.

The trend in the luxury market has shown a significant shift over the past decade. Luxury brands are not just about high prices anymore; they are about creating an experience and a story that justifies these prices. The global luxury market was valued at approximately $316 billion in 2019 and is projected to reach $382 billion by 2025. This growth is fueled by emerging markets and the increasing purchasing power of millennials and Gen Z consumers who prioritize experiences and brand stories over mere product ownership. Brands have responded by incorporating sustainability, heritage, and innovation into their narratives, thereby justifying their high price points.

The impact of high price points in the luxury world extends beyond individual brands and consumers; it affects the entire global market. High-priced luxury goods often signal economic stability and growth. For instance, during economic booms, sales of luxury goods tend to rise as more consumers feel financially secure enough to indulge in high-end products. Conversely, in times of economic downturns, luxury sales might dip, but the most prestigious brands often maintain their pricing strategies to preserve their brand image and exclusivity.

Luxury brands are also instrumental in driving trends in the broader consumer market. The concept of “trickle-down” fashion is evident here, where styles and products introduced by luxury brands eventually influence mass-market retailers. For example, when a high-end brand introduces a new handbag style or a particular fabric, it often sets off a trend that lower-priced brands replicate, making it accessible to a broader audience. This phenomenon underscores the importance of luxury brands in shaping overall market trends and consumer preferences.

The general customer market benefits indirectly from the innovations and trends set by luxury brands. For instance, technological advancements pioneered by luxury car manufacturers like Tesla or Mercedes-Benz eventually find their way into more affordable models. Similarly, the sustainable practices adopted by luxury fashion houses like Stella McCartney have encouraged a broader move towards ethical fashion in the mass market. These trickle-down effects help improve the quality and standards of products available to the general public, thereby elevating the overall consumer experience.

In recent times, the digital revolution has significantly impacted the luxury market, with e-commerce becoming a crucial sales channel. According to a 2020 report by Bain & Company, online sales of luxury goods grew by 23%, representing 12% of the market. This shift has forced luxury brands to rethink their strategies, focusing on creating exclusive online experiences that justify their high price points. For instance, Gucci and Burberry have developed sophisticated digital platforms that offer virtual try-ons, personalized shopping experiences, and exclusive online collections. These efforts not only enhance the customer experience but also help maintain the perception of exclusivity in the digital realm.

The rise of social media influencers has also played a pivotal role in the luxury market. Influencers with significant followings often showcase luxury products, creating aspirational desires among their audience. Brands like Dior and Balenciaga have successfully leveraged influencer marketing to reach younger demographics. This strategy has proven effective, as seen in a survey by McKinsey & Company, which found that 80% of luxury sales growth is driven by Gen Y and Gen Z consumers, who are highly influenced by social media and digital content.

Moreover, the emphasis on sustainability in the luxury sector has had a profound impact on consumer behavior and market dynamics. Brands are increasingly transparent about their supply chains and production processes, addressing consumer concerns about environmental and ethical practices. For example, LVMH, the parent company of brands like Louis Vuitton and Sephora, has made significant investments in sustainability initiatives, including reducing carbon emissions and promoting circular fashion. This commitment to sustainability resonates with environmentally conscious consumers and sets a benchmark for the entire industry.

The COVID-19 pandemic has also reshaped the luxury market, highlighting the resilience and adaptability of luxury brands. Despite a temporary dip in sales, the market quickly rebounded, driven by strong demand in China and the United States. Brands that adapted to the new normal by enhancing their digital presence and offering personalized virtual experiences saw significant growth. For instance, Hermès reported record sales in China after reopening its flagship store in Guangzhou, demonstrating the pent-up demand for luxury goods even during challenging times.

The importance of price point in the luxury world cannot be overstated. It is a critical factor that shapes brand identity, influences consumer behavior, and impacts global market trends. Luxury brands have adeptly navigated the evolving market landscape by focusing on exclusivity, storytelling, sustainability, and digital innovation. These strategies have not only reinforced their high price points but also set trends that influence the broader consumer market. As the luxury market continues to grow, driven by emerging markets and younger demographics, the interplay between price, value, and consumer experience will remain at the forefront of the industry’s evolution.

Why should you ship with SindoShipping and how is our company able to help you and your business to ship your goods and products to Indonesia?

Our company vision is to help companies around the world to be able to export their products to Indonesia with ease and expand their market worldwide especially in South East Asia as Indonesia is the leading internet market and largest economy around the region and to help ease the process of importation to the country and we want to help millions of Indonesian to access products worldwide with effective shipping system.

With the proper documentation and brokerage, we are able to help our customers ship a few categories of goods which have limited restrictions to Indonesia without any hassle to the customers address directly as we understand the process and the regulation of the imports including the taxation process of imports.

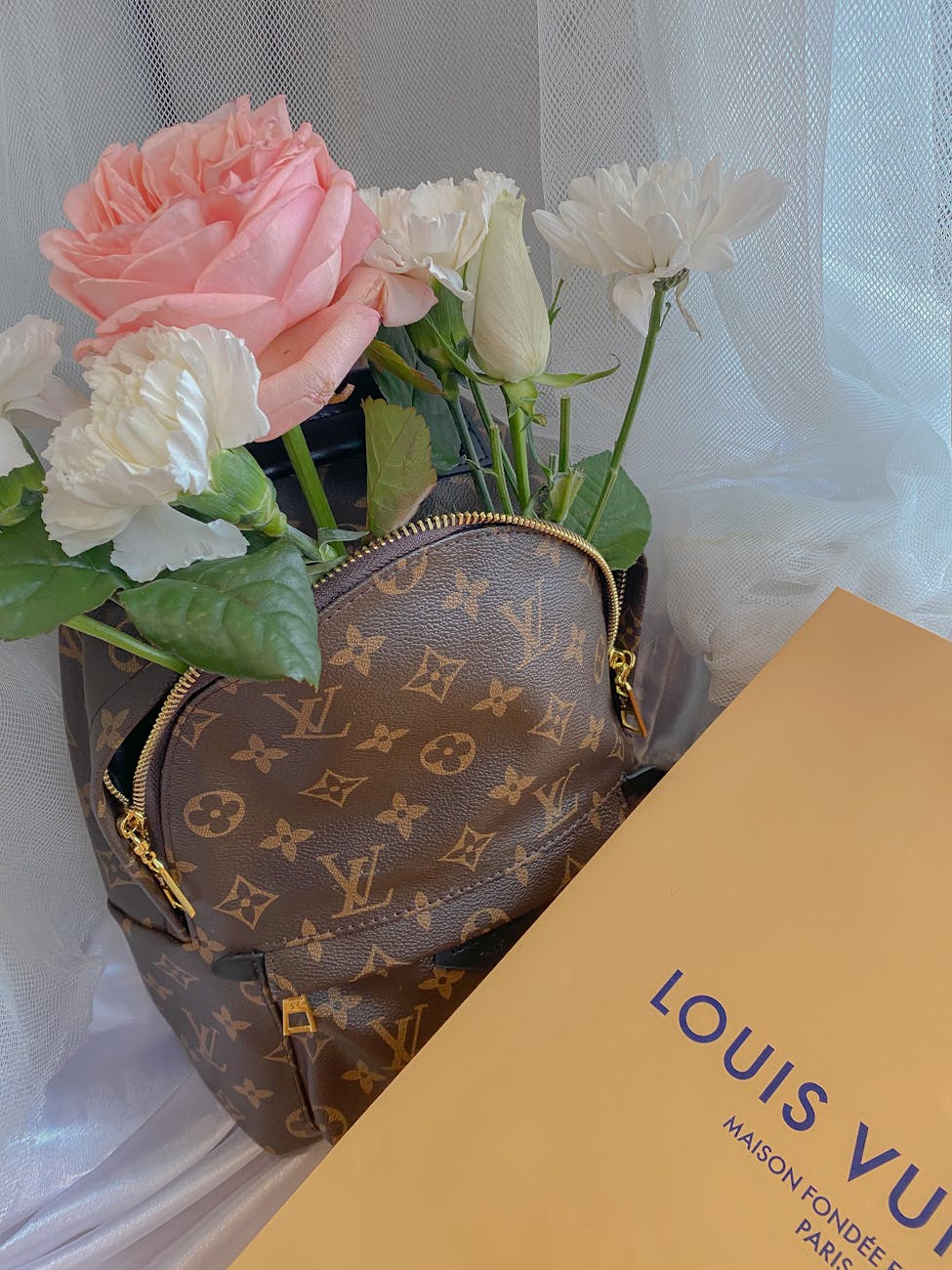

SindoShipping specialized in electronics, high tech products, cosmetics, luxury branded, toys, supplement and vitamins, fashion, bags and shoes, and traditional medicine shipping to Indonesia since 2014 with the top accuracy of shipment service and the live tracking available during the cross border shipment so the customer can feel safe and secure about their shipping. Contact us now for further details at 6282144690546 and visit out site sindoshipping.com