It is almost impossible to import goods to one country without customs clearance as every country have their own custom duty department as to make sure no illegal activities or goods imported to one’s countries won’t harm the community or nations.

Custom duty clearance is needed as the main purpose of custom is to seek whether every goods imported have special clearance to one country.

Another purpose of customs clearance is to control the inflow of goods imported to one’s country so it won’t harm the local market or local producers from the nation where the goods imported to.

Sometimes the country needs to control the market price of the commodity in their country to the restricted oversupply of the goods that make the price of the goods decreasing due to more supply than demand. Some commodities that imported to the country will directly increase the supply of particular goods in the market. The price of the commodity itself will decrease as too many goods in the market and will make the producer of typical same commodity from the country make a loss compare to the cost of producing it.

In the longer term, it might cost the local producers of the same typical goods suffer and will shut down the business due to loss of profit. For the longer term, it might affect the countrywide because the country will only rely on imports and the country that exporting the goods to a particular country might control the supply and price of the commodity.

Furthermore, another function of customs duty official is to protect the country from few types of animal that might have probability carrying virus or disease that will harm the nation and also dangerous plants that able to harm local produce commodity or farmers. The customs duty officer need to work together with the quarantine department in the front line at the borders and need to ensure that the goods, commodity, plant, animal imported to the country is safe.

Some case happened a few years back in regards to swine flu and bird flu that affects the whole world. Many restrictions happened in most of the countries with strict measures from custom duty agencies around the world as countries need to protect themselves from such an epidemic from animals carrying the virus that can harm population or some type of plant that can affect locally produce the commodity.

The role of customs duty department also crucial to help his or her country to increase the collection of tax and duties and in this case is from the importation of goods to the country. While you importing the goods to Indonesia, there are few taxes that you need to pay on top of import tax.

Few are VAT / GST tax of 11 percent from taxable amount, import duties 10-15 percent, personal or company income tax varies from 2,5 percent to 15 percent depending if you have complete documentation to import, then on top of that there are extra tax of 40-120 percent depending that whether your goods fall into the luxury category or not. Quite complicated compared to import some of the goods to maybe well-known transit country as Singapore, Hong Kong, Malaysia, etc.

Indonesia comes in at 108 out of 189 countries on the ease of trading across borders as to import the goods to. It takes approximately 99.4 hours to import a product or 4 days into Indonesia and the cost of an import average around USD 350 for containers.

The import tax system in Indonesia is more complicated than other countries as types of goods will affect the tax you need to pay with customs duty. The typical highest tax in Indonesia is luxury products that have luxury goods sales tax of 40 percent. Few types of goods that fell under this luxury tax such as

- alcoholic beverages

- tobacco products and such

- luxury vehicle and motorcycle

- essential oil and health-related product

- chemicals

- pharmaceutical products

- works of art

- arms and ammunition with permit

- garments for fencing and wrestling

- surgical gowns

- stretch limousines and cargo vehicles

- caviar

- luxury yacht

- aircrafts

- luxury properties

Rule of thumb of luxury goods tax is:

- the goods not for use or consumed by the general public

- only use or consumed by the certain community

- goods only use or consumed by the higher income community

- goods that use or consumed to show the status and social class

Here is some example of calculating luxury goods:

Example 1

Dony likes to buy a sports car from Singapore with the price of RP 900,000,000 to show his friends as a status symbol for him. With the regulation from the Tax and Customs Duties Agency, he needs to pay a luxury goods tax of 120 percent for luxury cars. His import tax calculation is (Dony has tax registration code):

Import Tax = 7.5% x 900,000,000 = 67,500,000

VAT (Value Added Tax) = 10% x 900,000,000 = 90,000,000

Income Tax 22 = 10% x Rp 900,000,000 = 90,000,000

Sales of Luxury Tax = 120% x Rp 900,000,000 = 1,080,000,000

Example 2

Tim wants to buy luxury watches from England. His order invoice stated Rp 180,000,000. How much the tax that Tim needs to pay? Tim does not have a tax registration code

Import Tax = 7.5% x 180,000,000 = 13,500,000

Income tax 22 = 20% x 180,000,000 = 36,000,000

VAT = 10 % x 180.000.000 = 18,000,000

Sales of Luxury Tax = 40% x 180,000,000 = 72,000,000

Total Tax = 139,500,000

In terms of payment method for the tax, few shipping companies able to help you to pay on your behalf with customs duty and you can use your credit card payment form of payment from the company.

Usually, only international shipping corporation that using this way such as FedEx, UPS, TNT, DHL but for local companies as Pos Indonesia or EMS, you need to pay cash on the pickup point if the goods already pass the clearance by customs duty officer as the only administrative amount needed to be pay.

The problem is arising when the customs duty officer is not satisfied with the documents produced as it is not compatible with the goods on the shipment (undervalue) or incomplete documents as few types of goods need special clearance from another department such as related health goods, food for animal, plants, etc.

As the shipper or recipient of the goods, you need to be responsible with custom duty officer demand and produce the complete documents required. The risk involved is your shipment might be confiscated, partially taken from your shipment, or your goods will be returning to the origin.

Here is the complete table in regards of the tax that you need to pay while importing to Indonesia.

Even though it would be a lot of effort needed to process the goods via custom clearance, the importer of the goods need to declare the goods as regulated in the country so the goods can be imported in a proper way, not through the back channel.

A few additional rules and regulation in regards to the customs clearance as referred to Indonesian Custom Website are :

- All cosmetics products need to have approval from BPOM (Indonesian Health Agency) as Information on Import Letter.

- When importing cellphone, handheld personal computers and computer tablets only allowed 2 pcs as regulated by Trading Ministry rules and regulations with custom need to be paid per shipment per recipient per day.

- Only able to import a maximum of 10 pcs of clothing per shipment per day as regulated by Trading Ministry rules and regulations.

- Electronic product only able to be imported maximum of 2 pcs per day per recipient as regulated by Trading Ministry rules and regulation

- All animal products, plants, fishes need to have import license from the Indonesian Quarantine Body.

- Firearms products, airsoft guns, and as such need to have a permit from the Police Department.

List of restricted items:

- Copier machine and products without a permit

- Dangerous materials for human health by direct on indirect use

- Unapproved pesticides

- Substances for Psychotropic activity without a permit

- Industrial waste without a permit

- Poison without permit

List of prohibited items:

- Grain or seed without a permit

- Medic Supplies

- Mineral or liquid products

- Explosive Products

- Narcos products

- Plant Seeds in a large amount

- Limited Tobacco products

- Beverages with alcohol or liquor.

- Sex toys and such

- Fireworks

- Gas and Petrol products

- Animal Skin and such

- Perishable items

- Pornography products

- Stuffed animal

- Gun or Weapon Replica

- Gambling devices

- Speargun and such

- Batteries and such

- CFC and related products

- Precious metal and mineral

- Therapeutic Products and such

- Endangered species and their products

- Nicotine Products

| Shipper that imported the goods via courier to received free tax declaration with a maximum invoice of the goods of USD 3 / day/ recipient. If the goods invoice between USD 3 – USD 1,500 there will be 10-15 percent tax applied and if the goods invoice is above USD 1,500, the recipient or shipper need to refer to the rules of limited importation and consult with custom immediately for referral on the process of importing the goods. |

Why shipping cross border or cross country cant be processed without custom clearance?

Shipping goods across borders or between countries has become an integral part of the global economy, fueling international trade and fostering connections between businesses and consumers worldwide. However, one cannot ignore the crucial role of customs clearance in facilitating this process. Without customs clearance, cross-border shipping would face insurmountable challenges, leading to delays, legal issues, and significant disruptions in the global supply chain. The importance of customs clearance is underscored by its impact on the market, reach, and trends, and it plays a vital role in shaping the world economy and consumer behavior.

The global e-commerce market has experienced exponential growth over the past decade, with cross-border e-commerce becoming a significant driver of this expansion. According to Statista, the global e-commerce market size is projected to reach $5.4 trillion by 2026, up from $4.2 trillion in 2020. This growth is fueled by the increasing number of consumers who prefer shopping online and the rising popularity of international brands. For instance, brands like Amazon, Alibaba, and Shopify have revolutionized how consumers purchase goods, offering a wide range of products from different countries with just a few clicks. However, the smooth functioning of this massive market would be impossible without the meticulous process of customs clearance.

Customs clearance is the process by which goods are inspected, documented, and approved by customs authorities to enter or exit a country. This process ensures that goods comply with the laws and regulations of the importing or exporting country. It involves several steps, including the submission of necessary documentation, payment of duties and taxes, and inspection of goods for compliance with health, safety, and environmental standards. While this process might seem cumbersome, it is essential for maintaining the integrity of cross-border trade and ensuring that only compliant goods enter the market.

One of the primary reasons why customs clearance is indispensable is the need to regulate and control the flow of goods into a country. This is particularly important in the context of international trade, where goods from different countries with varying standards and regulations are being exchanged. For example, a product manufactured in China may need to meet specific safety and quality standards before it can be sold in the European Union. Customs clearance acts as a checkpoint to ensure that these standards are met, protecting consumers from potentially harmful or substandard products.

Moreover, customs clearance plays a crucial role in the collection of revenue for governments. Customs duties, taxes, and tariffs are essential sources of income for many countries, helping fund public services and infrastructure projects. According to the World Trade Organization (WTO), customs duties accounted for approximately 1.6% of global government revenue in 2021, highlighting their significance in the global economy. Without customs clearance, it would be challenging to accurately assess and collect these revenues, leading to potential losses for governments.

The reach of customs clearance extends beyond the economic aspects to include security and safety concerns. In an increasingly interconnected world, where goods and people move across borders with unprecedented ease, customs clearance acts as a frontline defense against illegal activities such as smuggling, trafficking, and the entry of counterfeit goods. For instance, the United States Customs and Border Protection (CBP) seized over 27,000 shipments containing counterfeit goods in 2022, with an estimated retail value of $1.3 billion. These goods ranged from luxury items like counterfeit designer handbags to potentially dangerous counterfeit pharmaceuticals. Customs clearance helps mitigate such risks, ensuring that only legitimate and safe products reach consumers.

Recent trends in global trade have further highlighted the importance of customs clearance. The COVID-19 pandemic, for instance, brought to the forefront the challenges of managing cross-border shipments during a global crisis. The pandemic disrupted global supply chains, leading to delays in the movement of goods and a surge in demand for certain products, such as personal protective equipment (PPE) and medical supplies. Customs authorities worldwide had to adapt quickly to facilitate the swift clearance of essential goods while ensuring compliance with health and safety regulations. The pandemic underscored the need for efficient and agile customs processes to respond to unforeseen challenges in the global market.

Another trend shaping the role of customs clearance is the rise of digitalization and automation in the logistics industry. Technologies such as blockchain, artificial intelligence (AI), and the Internet of Things (IoT) are being increasingly integrated into customs processes to streamline operations and enhance efficiency. For example, Maersk, one of the world’s largest shipping companies, has partnered with IBM to develop TradeLens, a blockchain-based platform that enables secure and transparent data exchange between stakeholders in the supply chain. This technology helps expedite customs clearance by providing real-time visibility into the movement of goods and automating documentation processes. As a result, it reduces the time and cost associated with cross-border shipping, benefiting both businesses and consumers.

The impact of customs clearance on the world market is profound. It ensures that international trade operates smoothly, enabling businesses to expand their reach and tap into new markets. For instance, small and medium-sized enterprises (SMEs) that previously faced barriers to entering international markets can now leverage e-commerce platforms and streamlined customs processes to reach customers worldwide. According to the International Trade Centre (ITC), SMEs account for 95% of all businesses globally and contribute to 60-70% of global employment. By facilitating cross-border trade through efficient customs clearance, these businesses can grow and contribute to economic development on a global scale.

From a consumer perspective, customs clearance is crucial in ensuring access to a wide range of products from different countries. Consumers today have more choices than ever before, thanks to the globalization of trade. Whether it’s a fashion item from Italy, electronics from Japan, or gourmet food from France, customs clearance ensures that these products are available to consumers in different parts of the world. Moreover, it provides a level of assurance that the products they purchase meet the required standards and are safe for use.

However, the importance of customs clearance is not without challenges. One of the significant issues faced by businesses and consumers alike is the complexity and variability of customs regulations across different countries. Each country has its own set of rules and procedures, making it challenging for businesses to navigate the customs clearance process, especially when shipping to multiple destinations. This complexity can lead to delays, increased costs, and, in some cases, the rejection of shipments. To address this, there is a growing need for international cooperation and harmonization of customs regulations. Organizations like the World Customs Organization (WCO) are working towards standardizing customs procedures to facilitate smoother and more predictable cross-border trade.

Customs clearance is an indispensable aspect of cross-border shipping that cannot be overlooked. It plays a vital role in regulating international trade, ensuring the safety and security of goods, collecting government revenue, and enabling businesses to expand their reach. As the global market continues to grow and evolve, the importance of efficient and agile customs clearance processes will only increase. Recent trends such as digitalization and the challenges posed by the COVID-19 pandemic have further underscored the need for robust customs systems that can adapt to changing circumstances. For businesses and consumers alike, understanding the significance of customs clearance is essential for navigating the complexities of cross-border trade and maximizing the opportunities presented by the global market.

Why custom clearance needed to control inflow of goods imported to one’s country?

Custom clearance plays an indispensable role in controlling the inflow of goods imported into a country. In today’s increasingly interconnected global economy, where goods, services, and capital move across borders more freely than ever before, the process of customs clearance serves as a crucial checkpoint that ensures the balance between facilitating trade and protecting national interests. The importance of this process is multifaceted, touching upon market control, safeguarding domestic industries, maintaining security, and ensuring that international trade operates within the frameworks of legality and fairness.

The global market, as it stands today, is a vast network of countries, companies, and consumers, all of which are connected through a complex web of trade relationships. According to the World Trade Organization (WTO), the global trade in goods was valued at approximately $19 trillion in 2023. This staggering figure underscores the scale and reach of international trade and highlights why controlling the inflow of goods is crucial. Without proper customs clearance, countries would be vulnerable to an unregulated flood of imports, which could destabilize domestic markets, undermine local industries, and lead to significant economic imbalances.

One of the primary reasons custom clearance is needed is to protect domestic markets and industries from being overwhelmed by foreign competition. Countries often have industries that are vital to their economy, providing jobs, generating income, and driving innovation. However, these industries can be threatened by cheaper or superior imported goods. For instance, the influx of inexpensive textiles from countries like China and India has historically posed challenges for domestic textile industries in countries such as the United States and the United Kingdom. By regulating the inflow of these goods through customs, governments can impose tariffs, quotas, or even bans to protect local industries from unfair competition and to give them a fighting chance in the global market.

Custom clearance also plays a vital role in ensuring that imported goods meet the necessary safety and quality standards. In a world where consumer safety is paramount, allowing unchecked imports could lead to the proliferation of substandard or dangerous products in the market. For example, in 2022, there was a significant recall of toys in the European Union due to safety concerns regarding harmful chemicals in plastics. Without stringent customs checks, such products could easily enter the domestic market, posing serious health risks to consumers, particularly children. By controlling the inflow of goods, customs authorities can prevent such risks, ensuring that only products that meet the country’s safety and quality standards are allowed in.

Another critical aspect of customs clearance is its role in revenue generation. Import duties and taxes collected by customs authorities are a significant source of revenue for many countries. For example, in 2023, customs duties contributed over $50 billion to the U.S. federal revenue. This revenue is essential for funding public services and infrastructure, making it crucial for governments to control the flow of goods into the country to maximize this income. Furthermore, by managing the inflow of goods, customs authorities can prevent tax evasion and ensure that all due revenues are collected.

The global market is also increasingly characterized by the prevalence of counterfeit goods, which pose a significant threat to legitimate businesses and economies. The World Customs Organization (WCO) reported that the trade in counterfeit goods was worth over $500 billion in 2023, accounting for approximately 3.3% of global trade. Custom clearance is a frontline defense against this issue, allowing authorities to identify and seize counterfeit goods before they can enter the market. For instance, in 2023, U.S. customs authorities seized counterfeit electronics worth over $1 billion, preventing these products from reaching consumers and protecting legitimate businesses from unfair competition.

In the context of recent global trends, the rise of e-commerce has further underscored the need for robust customs clearance processes. E-commerce has revolutionized the way people shop, making it easier than ever for consumers to purchase goods from overseas. In 2023, global e-commerce sales reached an estimated $5.7 trillion, with a significant portion of these sales involving cross-border transactions. While this has expanded the reach of global markets, it has also created new challenges for customs authorities, who must now process an ever-increasing volume of small parcels entering the country. In response, many countries have introduced new regulations and technologies to improve the efficiency and effectiveness of customs clearance. For example, in 2022, the European Union implemented new VAT rules for e-commerce, requiring online sellers to collect VAT on all sales to EU consumers, regardless of the value of the goods. This has helped to level the playing field between domestic and foreign sellers while ensuring that customs duties are properly collected.

The impact of customs clearance on the world market and the general world customer market cannot be overstated. In a world where supply chains are increasingly global, delays or inefficiencies in customs clearance can have significant ripple effects. For instance, the COVID-19 pandemic highlighted the vulnerabilities of global supply chains, with many countries experiencing delays in the importation of essential goods such as medical supplies and food. This has led to renewed focus on the importance of customs clearance in ensuring the smooth and timely flow of goods across borders. In 2023, global supply chain disruptions led to an estimated loss of $4 trillion in global trade, underscoring the critical role of efficient customs processes in maintaining the stability of international trade.

Moreover, customs clearance is essential for maintaining national security. In a world where threats such as terrorism, smuggling, and the proliferation of illegal goods are ever-present, customs authorities serve as the first line of defense. By controlling the inflow of goods, they can prevent the entry of illegal weapons, drugs, and other contraband that could pose a threat to public safety. For instance, in 2023, U.S. Customs and Border Protection seized over 1 million pounds of illegal drugs at the border, preventing these dangerous substances from entering the country and protecting public health and safety.

Custom clearance also plays a role in enforcing international agreements and trade policies. Many countries are members of international trade organizations such as the WTO, which set rules and standards for global trade. By controlling the inflow of goods, customs authorities ensure that imports comply with these rules, helping to maintain the integrity of the international trading system. For example, in 2022, the United States imposed tariffs on steel and aluminum imports from certain countries to protect its domestic industries and address concerns about unfair trade practices. Customs authorities were instrumental in enforcing these tariffs, ensuring that the country’s trade policies were effectively implemented.

Custom clearance is a vital process that is essential for controlling the inflow of goods imported into a country. It plays a crucial role in protecting domestic markets and industries, ensuring the safety and quality of imported goods, generating revenue, preventing counterfeit goods, and maintaining national security. In a global market characterized by increasing trade volumes, the rise of e-commerce, and growing security threats, the importance of efficient and effective customs clearance cannot be overstated. As countries continue to navigate the complexities of international trade, customs authorities will remain at the forefront, ensuring that the benefits of global trade are realized while mitigating its risks.

How custom duty department in one’s country role is crucial to increase collection of tax and duties?

The role of the customs duty department in a country is one of the most critical elements in the architecture of national economic management. This department is responsible for collecting taxes and duties on imports and exports, a task that has significant implications for the broader economic landscape. With globalization and the interconnectedness of world markets, the efficiency and effectiveness of the customs duty department have become even more crucial. The importance of this department is not limited to national revenue collection; it also extends to market regulation, protection of domestic industries, and maintaining a level playing field in the global marketplace.

Customs duties serve as a significant source of revenue for governments. In some countries, particularly those with less diversified economies, customs duties can account for a substantial portion of the national budget. For instance, in developing countries, customs duties can represent up to 50% of government revenue. Even in more developed economies, where the reliance on customs duties is lower, they still contribute a significant amount to the national treasury. In the United States, for example, customs duties generated approximately $85 billion in revenue in 2023. This figure represents a crucial component of the federal budget, helping to fund essential public services such as healthcare, education, and infrastructure development.

The role of the customs duty department extends beyond mere revenue collection. It plays a vital part in regulating the market by imposing duties on imported goods, which can help protect domestic industries from unfair competition. This regulatory function is particularly important in sectors where local industries are still developing and may not be able to compete on an equal footing with established foreign competitors. For example, the imposition of anti-dumping duties on imported steel in the European Union has been crucial in protecting the domestic steel industry from being overwhelmed by cheaper imports from countries like China. This not only safeguards jobs in the domestic market but also ensures the survival and growth of key industries.

Customs duties also play a significant role in shaping consumer behavior and preferences. By imposing higher duties on luxury goods, for example, governments can discourage the importation and consumption of non-essential items, thereby encouraging consumers to focus on more essential and domestically produced goods. This can have a ripple effect on the economy, promoting local industries and reducing the outflow of foreign exchange. In India, for instance, the government has implemented higher customs duties on imported electronics to encourage local production under the “Make in India” initiative. This has led to a significant increase in domestic production of electronics, with the market size growing from $31 billion in 2014 to $400 billion in 2023.

The impact of the customs duty department on the global market is profound. In today’s interconnected world, trade policies and customs duties in one country can have far-reaching effects on global supply chains and market dynamics. The recent trade tensions between the United States and China, for example, have had a significant impact on global trade flows. The imposition of higher tariffs on Chinese goods by the United States led to a shift in global supply chains, with companies moving production to other countries to avoid the tariffs. This has resulted in a redistribution of trade flows, with countries like Vietnam and Mexico benefiting from increased exports to the United States. In 2022, Vietnam’s exports to the United States increased by 33%, reaching a record high of $117 billion.

Customs duties also play a crucial role in controlling the flow of goods across borders, which has implications for national security and public safety. By regulating the importation of goods, customs duty departments can help prevent the entry of harmful or substandard products into the market. This is particularly important in sectors such as pharmaceuticals and food products, where the quality and safety of goods can have direct implications for public health. The recent recall of contaminated baby formula from China highlighted the importance of effective customs regulation in protecting consumers. By imposing strict controls on the importation of food products, customs duty departments can help ensure that only safe and high-quality goods reach consumers.

The customs duty department’s role in tax collection is also crucial in the context of e-commerce and the digital economy. With the rapid growth of online shopping, the volume of cross-border transactions has increased significantly, creating new challenges for customs duty departments. In 2023, global e-commerce sales reached $5.5 trillion, with a significant portion of these transactions involving cross-border trade. The customs duty department must adapt to these changes by implementing new regulations and technologies to ensure that taxes and duties are appropriately collected on these transactions. This includes the implementation of digital platforms for customs declarations and the use of data analytics to track and monitor cross-border transactions. By doing so, customs duty departments can help ensure that the growing e-commerce market contributes its fair share to national tax revenues.

The effectiveness of the customs duty department also has implications for the ease of doing business in a country. Efficient customs procedures can reduce the time and cost associated with importing and exporting goods, making a country more attractive to international trade. According to the World Bank’s Doing Business Report 2023, countries that have streamlined customs procedures and reduced the administrative burden on businesses have seen significant improvements in their rankings. For example, Singapore, which is consistently ranked as one of the easiest places to do business, has implemented a highly efficient customs system that allows for the rapid clearance of goods. This has made Singapore a major global trade hub, with total trade volume reaching $1.1 trillion in 2023.

The customs duty department plays a vital role in increasing the collection of taxes and duties, which are crucial for national revenue generation and economic stability. Its role extends beyond mere revenue collection to include market regulation, consumer protection, and the facilitation of international trade. As global trade dynamics continue to evolve, the importance of an efficient and effective customs duty department will only increase. By adapting to new challenges and leveraging technology, customs duty departments can ensure that they continue to play a crucial role in the global economy, contributing to the growth and development of both national and international markets. The ability of a country to effectively manage its customs duties will be a key determinant of its economic success in the increasingly interconnected world of the 21st century.

Why there are luxury tax when importing certain product to Indoneisia?

Luxury taxes on imported products in Indonesia are a subject of much debate, and they serve multiple purposes within the country’s economic and social policies. At its core, the luxury tax is designed to regulate the flow of high-end goods into the market, ensuring that the wealthiest segments of society contribute more to the nation’s revenue. This tax also plays a crucial role in shaping consumer behavior, influencing market trends, and maintaining a balance between imported and locally produced goods.

Indonesia, with its rapidly growing economy, has become an increasingly attractive market for luxury goods. The country’s middle and upper classes have expanded significantly over the past few decades, leading to a surge in demand for high-end products such as luxury cars, designer clothing, and high-tech gadgets. In response to this growing demand, the Indonesian government has implemented a luxury tax on certain imported goods to manage the inflow of these products, protect local industries, and generate additional revenue for public spending.

The luxury tax is often seen as a tool to curtail excessive consumption of imported goods that may otherwise dominate the market and stifle the growth of domestic products. For instance, high tariffs on imported luxury cars can encourage consumers to opt for locally manufactured vehicles, which in turn supports the local automotive industry. This kind of protectionism is not unique to Indonesia; many countries impose similar taxes to protect their domestic markets. However, the effectiveness of these measures can vary, depending on the elasticity of demand for the taxed products and the availability of local alternatives.

Indonesia’s luxury tax has a broad reach, impacting various sectors of the market. One of the most affected industries is the automotive sector. Luxury vehicles, often imported from countries like Germany, Japan, and the United States, are subject to high tariffs that can range from 40% to 150% of the vehicle’s value. This significant tax burden makes luxury cars considerably more expensive in Indonesia compared to other markets. For example, a high-end Mercedes-Benz or BMW that might cost $100,000 in its country of origin could end up costing upwards of $200,000 or more in Indonesia after taxes. This pricing strategy not only limits the number of luxury vehicles on the road but also incentivizes consumers to consider more affordable, locally produced cars.

The reach of the luxury tax extends beyond automobiles to include products like high-end electronics, luxury fashion items, and premium home appliances. For instance, a luxury smartphone brand like Apple, which already carries a premium price tag, becomes even more expensive when imported into Indonesia. The iPhone, a symbol of technological luxury, is often seen as a status symbol, and despite the higher prices, demand remains strong among the affluent. However, the luxury tax does act as a deterrent to some extent, pushing consumers towards either delaying their purchase or opting for less expensive models or alternative brands. This trend has implications for global tech giants, as they must navigate the complexities of pricing strategies in markets with high luxury taxes.

Trends in the Indonesian market indicate a growing awareness and sensitivity towards the luxury tax. Consumers, particularly those in the middle and upper-middle classes, are becoming more discerning in their purchasing decisions. They are increasingly aware of the price differences between imported and locally produced goods and are more likely to weigh the cost-benefit ratio before making a purchase. This trend is further amplified by the rise of e-commerce platforms, which offer consumers greater access to a wider range of products, including those that might be subject to luxury taxes. As a result, there is a noticeable shift towards online shopping, where consumers can sometimes find better deals on luxury goods, even after accounting for import duties and taxes.

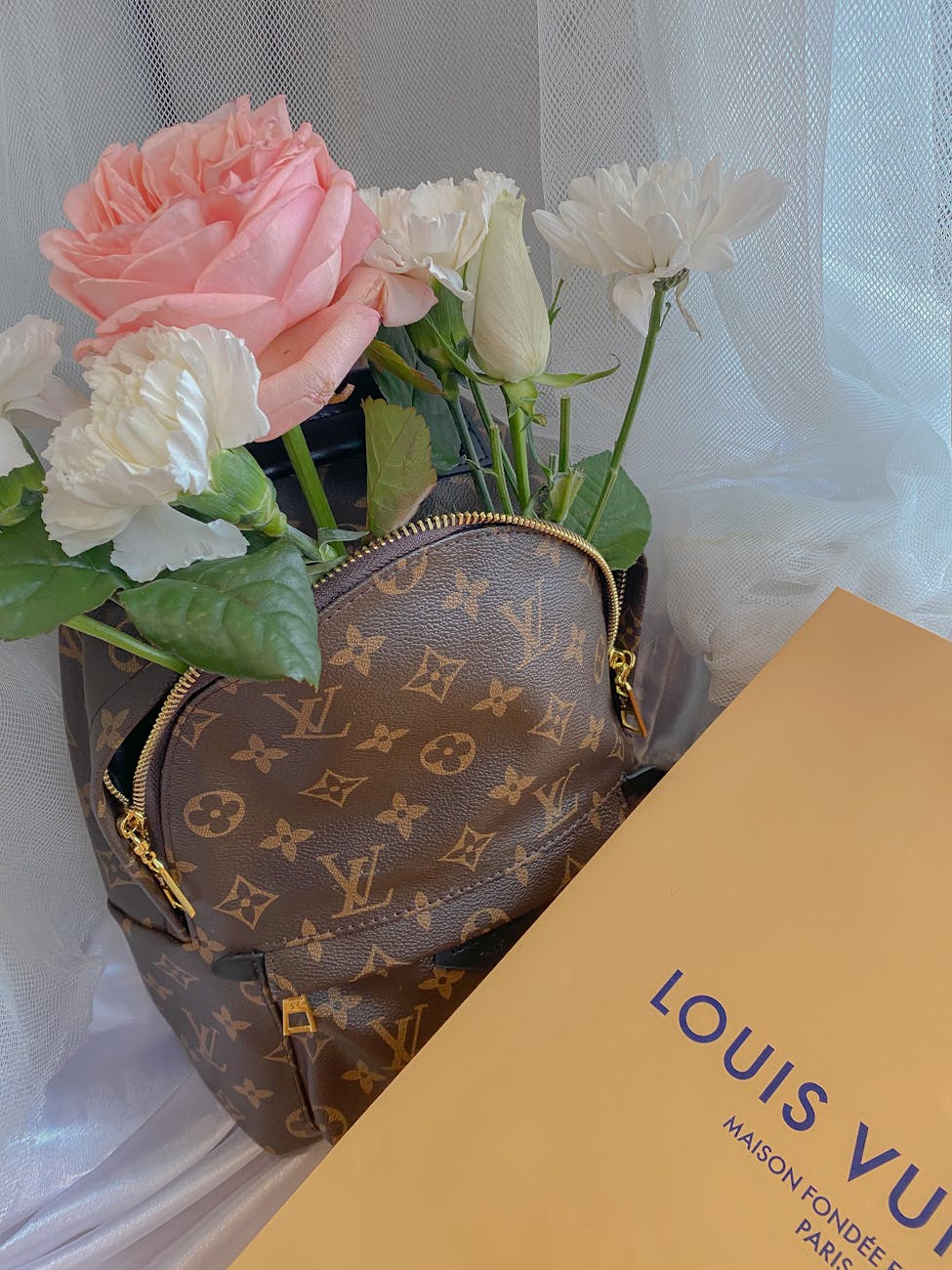

The impact of Indonesia’s luxury tax on the world market is multifaceted. On one hand, it influences the pricing strategies of multinational corporations seeking to tap into the lucrative Indonesian market. Brands like Louis Vuitton, Gucci, and Rolex must consider the additional costs that their customers will incur due to the luxury tax. This often leads to higher retail prices in Indonesia compared to other markets, which can affect global pricing strategies and brand positioning. On the other hand, the luxury tax can also create opportunities for global brands to explore local production options, thereby bypassing the high import taxes and gaining a competitive edge in the market.

For the general world customer market, Indonesia’s luxury tax presents both challenges and opportunities. Global consumers who are accustomed to purchasing luxury goods in their home countries may find the higher prices in Indonesia prohibitive, leading them to either limit their purchases or seek alternatives. This can have a ripple effect on global demand for certain luxury products, particularly if other countries follow Indonesia’s lead in implementing similar taxes. However, for discerning consumers, the luxury tax can also be seen as a reflection of the product’s exclusivity and desirability, further enhancing the brand’s allure.

In recent years, there have been instances where brands have adapted their strategies to align with Indonesia’s luxury tax policies. For example, luxury automotive brands have introduced lower-displacement engines or hybrid models to reduce the tax burden on their vehicles, making them more accessible to Indonesian consumers. Similarly, high-end fashion brands have explored the possibility of local production or partnerships with Indonesian designers to create exclusive collections that are not subject to the same level of taxation as imported goods. These strategies not only help brands maintain their presence in the market but also foster a sense of exclusivity and uniqueness that appeals to the Indonesian consumer.

The luxury tax in Indonesia is also indicative of a broader global trend towards taxing the wealthy and high-end consumption. As income inequality continues to be a pressing issue worldwide, more governments are likely to adopt similar measures to ensure that the wealthiest individuals contribute a fair share to public coffers. This trend is particularly relevant in emerging markets like Indonesia, where the gap between the rich and the poor is often stark. By imposing taxes on luxury goods, the government aims to redistribute wealth and fund social programs that benefit the broader population.

The luxury tax on imported products in Indonesia serves multiple purposes, from protecting local industries and generating revenue to shaping consumer behavior and influencing global market trends. While it presents challenges for both consumers and global brands, it also creates opportunities for innovation and adaptation. As the Indonesian market continues to evolve, the luxury tax will remain a key factor in the country’s economic landscape, reflecting broader global trends towards wealth redistribution and responsible consumption. Brands and consumers alike must navigate this complex terrain, balancing the desire for luxury with the realities of taxation and market dynamics.

Why importing alcoholic beverages to Indonesia difficult and expensive?

Importing alcoholic beverages to Indonesia is an endeavor fraught with difficulties and expenses, largely due to a complex interplay of regulatory, cultural, and economic factors. Indonesia, with its vast archipelago and diverse population, presents a unique market landscape that is challenging for international alcohol brands to navigate. The intricacies of this market are further compounded by a stringent regulatory framework, high import tariffs, and a societal backdrop that is not uniformly receptive to alcohol consumption.

Indonesia’s alcoholic beverage market is relatively small compared to other Southeast Asian nations, largely due to its significant Muslim population, which constitutes about 87% of its 270 million citizens. Islam prohibits the consumption of alcohol, leading to a lower domestic demand compared to countries where alcohol is more culturally accepted. However, there is still a niche market within Indonesia, particularly in urban centers like Jakarta and Bali, where expatriates, tourists, and non-Muslim locals drive demand. Despite this demand, the market remains tightly regulated. The government imposes strict licensing requirements for the sale of alcohol, and these licenses are often difficult to obtain, particularly for imported brands.

One of the primary challenges in importing alcoholic beverages to Indonesia is the high cost associated with tariffs and taxes. Indonesia has one of the highest import duties on alcoholic beverages in the world, which can range from 150% to 500% of the product’s value, depending on the type of alcohol. This is coupled with additional taxes, such as the luxury goods sales tax, which can further inflate the cost. For example, a bottle of imported wine that costs $10 in its country of origin can end up retailing for $50 or more in Indonesia after all taxes and markups are applied. These high costs make imported alcoholic beverages a luxury item in Indonesia, accessible only to a small segment of the population. This limited accessibility naturally curtails the potential market size for international brands, making it less attractive for them to invest heavily in distribution and marketing within the country.

The logistical challenges of reaching the Indonesian market are another significant barrier. Indonesia is an archipelago of over 17,000 islands, and distributing products across this vast and fragmented landscape is both costly and complex. The country’s infrastructure, while improving, still presents challenges, particularly in more remote regions. Shipping costs are high, and there are often delays in getting products through customs, where bureaucratic red tape can add further complications. These logistical issues can result in inconsistent supply chains, where products may not always be available to consumers when they want them, further dampening demand.

In recent years, there has been a global trend towards premiumization in the alcoholic beverage industry, with consumers increasingly seeking out high-quality, craft, and artisanal products. This trend has been evident in markets like the United States and Europe, where craft beer, fine wines, and boutique spirits have seen significant growth. However, this trend has been slower to take hold in Indonesia, partly due to the aforementioned cost and accessibility issues. While there is a small but growing market for premium alcoholic beverages among Indonesia’s affluent consumers, it remains a niche segment that is difficult for international brands to penetrate without significant investment.

The impact of these challenges on the global alcoholic beverage market is significant. Indonesia, as one of the largest economies in Southeast Asia, represents a potentially lucrative market for international alcohol brands. However, the difficulties associated with importing alcoholic beverages into the country mean that many brands choose to focus their efforts on other markets where the regulatory environment is more favorable, and the potential return on investment is higher. This has led to a situation where the Indonesian market is largely underserved by international alcohol brands, with a limited range of products available to consumers. This, in turn, affects consumer choice, as well as the overall diversity of the market.

For the general world customer market, the difficulties associated with importing alcohol into Indonesia can have a ripple effect. As international brands allocate their resources to more accessible markets, the range of products available to consumers in Indonesia remains limited. This can create a sense of exclusivity around certain brands or products, making them more desirable to consumers who are willing to pay a premium for imported goods. However, for the majority of consumers, this exclusivity comes at the cost of accessibility, as the high prices and limited availability of imported alcohol mean that many are unable to experience the full range of products available on the global market.

From a global perspective, the challenges associated with importing alcohol into Indonesia also have implications for international trade and the global supply chain. Indonesia’s high tariffs and complex regulatory environment can serve as a barrier to trade, limiting the ability of international brands to enter the market and compete on an equal footing with local producers. This can stifle competition and innovation within the market, as international brands are deterred from investing in product development or marketing in a market where the return on investment is uncertain. Furthermore, the logistical challenges of distributing products across Indonesia’s vast and fragmented landscape can create additional hurdles for international brands, as they must navigate a complex web of supply chains and distribution networks to reach consumers.

In recent years, there have been some efforts to address these challenges and make the Indonesian market more accessible to international alcohol brands. The government has introduced reforms aimed at streamlining the licensing process and reducing some of the bureaucratic hurdles associated with importing alcohol. Additionally, there have been discussions around lowering tariffs on imported alcohol as part of broader trade negotiations with other countries. However, these reforms have been slow to materialize, and the overall regulatory environment remains challenging for international brands.

Importing alcoholic beverages to Indonesia is a complex and costly endeavor, driven by a combination of regulatory, cultural, and logistical factors. While there is a small but growing market for premium alcoholic beverages in Indonesia, the high costs associated with import tariffs and taxes, coupled with the logistical challenges of reaching the market, make it a difficult market for international brands to penetrate. The impact of these challenges is felt not only within Indonesia but also in the broader global market, as international brands are deterred from investing in a market where the return on investment is uncertain. As a result, the Indonesian market remains largely underserved by international alcohol brands, with limited choices available to consumers. While there have been some efforts to address these challenges, significant barriers remain, making Indonesia a difficult and expensive market for imported alcoholic beverages.

How long usually the time for the goods to be cleared in Indonesian custom?

It is varies depending on whether your goods have a full set of documentation or the customs duty officer is satisfied with your presentation of your shipment. Few secrets from the industry are to have proper shipping package that is common and does not attract unnecessary attention from custom duty officer.

The usual time of clearance is between 3-5 working days since your goods in customs clearance. A longer period may apply if the customs duty officer need to have more data or document before clearance.

How come the packaging of the goods can make any difference in shipping to Indonesia?

The first measurement that the custom duty officer looks over is whether the goods coming from countries with a lot of cases on illegal activities. Custom duty officer will strengthen the check for the list of countries which have a high bad reputation for drug abuse, illegal drug trade, countries that produce a psychotropic drug, etc.

If the goods coming from the USA or any first world country, the custom officer will tend to seek or glance through the invoice and the commodity of the goods and scanned it through x-ray machine to determine the goods inside the package or when the custom duty officer in doubt, he/ she will open your package to have physical checks of the package to make sure it matches the invoice stated.

The package of goods plays quite an important role while shipping to the country. The package that in unusual shape of boxes might have a high chance of being open and scan through the x-ray machine to check it thoroughly.

Next, when the customs duty officer spotted some goods with bulky or big boxes as with the characteristic that the goods are for commercial and not for personal use, the customs duty officer will take a closer look on the package.

And more checks will be on few personal goods that label as gifts or online purchase with a small package as suspected of high-value electronics/ phones.

Few another type of packages that the customs officer will have closer look are the boxes with improper packaging that resulted from some leaks due to the liquid transportation or the package with a pungent smell that usually comes from perishable products, etc.

Well, it is important to learn how to pack properly as the basic foundation to ship your products and help your product secure.

Here are a few steps on how to pack your goods prior to shipping like professional

SindoShipping helps the customer to import their goods to Indonesia with a brokerage system with Indonesia custom, as we screen of every good that imported to Indonesia with maximum efforts as no illegal goods imported without declaring to custom.

Our system has been successfully implemented as the goods that through custom able to have clearance status immediately thus able to help customer received the goods as soon as possible after the customs clearance.

It is important for the customer to consult with our staff in regards of the goods imported to Indonesia to have a clear picture on how need to declare the goods to Indonesia without any problem with the smoother process with the custom and our company offer the service to each customer the brokerage with Indonesian custom.

Contact one of our professional staff to obtain more info in regards to shipping or just WhatsApp to 6281296055142. Sindoshipping- best shipping service to Indonesia as we have years of experience in the international shipping industry especially to the Indonesian market.

Why should you ship with SindoShipping and how is our company able to help you and your business to ship your goods and products to Indonesia?

Our company vision is to help companies around the world to be able to export their products to Indonesia with ease and expand their market worldwide especially in South East Asia as Indonesia is the leading internet market and largest economy around the region and to help ease the process of importation to the country and we want to help millions of Indonesian to access products worldwide with effective shipping system.

With the proper documentation and brokerage, we are able to help our customers ship a few categories of goods which have limited restrictions to Indonesia without any hassle to the customers address directly as we understand the process and the regulation of the imports including the taxation process of imports.

SindoShipping specialized in electronics, high tech products, cosmetics, luxury branded, toys, supplement and vitamins, fashion, bags and shoes, and traditional medicine shipping to Indonesia since 2014 with the top accuracy of shipment service and the live tracking available during the cross border shipment so the customer can feel safe and secure about their shipping. Contact us now for further details at 6282144690546 and visit out site sindoshipping.com

Leave a reply to Shipping to Indonesia: Expectation vs Reality – SindoShipping Cancel reply