When travelers from across Asia flock to Japan with empty suitcases and return with branded goods packed to the brim, they are tapping into an economic phenomenon that combines favorable tax policy, a strategic tourism approach, and the unique cultural appeal of Japanese retail. Japan has earned a reputation as a shopper’s paradise not just because of the sheer variety of luxury and branded goods but also because of pricing factors that make these products feel more accessible compared to other Asian markets. The Japanese government has long leveraged its consumption tax exemption policy for tourists, which essentially allows international visitors to shop tax-free on a wide range of goods, including high-end luxury brands. This policy, when combined with a currency that has remained relatively stable or weak against other Asian currencies in recent years, creates a sweet spot for bargain-hungry consumers.

The appeal of Japan as a destination for luxury shopping is also deeply rooted in its robust tourism ecosystem. Even before the pandemic, Japan was drawing millions of tourists annually, with a significant portion from China, South Korea, Taiwan, and Southeast Asia. These visitors see Japan not just as a cultural experience but also as a trusted retail haven where authenticity and quality are practically guaranteed. This trust factor matters immensely in the branded goods market, where concerns about counterfeits can dampen the appeal in other regional shopping hubs. In cities like Tokyo, Osaka, and Kyoto, entire shopping districts are curated to cater to affluent tourists with multilingual staff, tax refund counters, and exclusive offers. This infrastructure fuels a cycle where high tourism boosts retail sales, which in turn supports competitive pricing by driving up volumes for luxury houses like Louis Vuitton, Chanel, and Dior.

Comparing Japan to other Asian countries like Singapore, Hong Kong, or South Korea reveals that Japan’s tax incentives can offer a real price edge. While Singapore and Hong Kong have traditionally been popular for luxury shopping due to their tax regimes and status as free ports, recent years have seen Japan catching up rapidly thanks to the sheer scale of its inbound tourism and the aggressive promotions that luxury brands run to capture tourist spending. South Korea has also ramped up its duty-free retail offerings, but language barriers, less perceived trust in product authenticity, and regional tensions can dampen the shopping experience for some visitors. Japan, by contrast, remains neutral ground with a reputation for impeccable service and an enjoyable shopping environment.

It is worth noting that Japan’s domestic appetite for branded goods also drives economies of scale that benefit foreign buyers. Luxury and premium brands see Japan not merely as a tourist marketplace but as an entrenched local luxury market. According to recent market data, Japan consistently ranks among the top five countries for luxury brand revenue worldwide. Domestic consumers are loyal, and this high baseline demand means that brands are able to sustain flagship stores, run frequent exclusive launches, and offer broader stock availability. This contrasts with smaller or less luxury-focused Asian markets where the selection may be narrower, leading buyers to feel they must pay premium prices for limited stock.

Currency fluctuations further complicate the picture but often work in favor of the Japanese market’s competitiveness. In the past decade, periods of yen depreciation have repeatedly triggered shopping booms as tourists seize the opportunity to buy luxury products at a relative discount when converted to their home currency. Luxury houses have responded with limited-edition Japan-only releases that drive demand even higher, making the country feel like a must-visit destination for the fashion-savvy. While markets like Hong Kong are experiencing political and economic uncertainties that have sometimes hurt luxury retail, Japan’s relative stability continues to make it an attractive alternative.

Beyond pricing, cultural and experiential factors give Japan an edge that’s hard to replicate elsewhere in Asia. Shopping for luxury goods in Japan is intertwined with the broader hospitality culture of omotenashi—unmatched attention to detail and customer care. Tourists often describe their in-store experiences as more refined and personalized, with packaging, after-sales support, and even unique Japanese brand collaborations adding extra perceived value. This enhances the overall perception that buying luxury goods in Japan is not just about getting a better deal but also about enjoying an experience that feels exclusive and premium.

Another emerging trend that strengthens Japan’s appeal is the blending of luxury shopping with tourism experiences. High-end department stores like Isetan and Mitsukoshi are integrating art exhibitions, pop-up collaborations, and gourmet experiences that keep affluent tourists engaged longer. The result is that visitors are more likely to splurge, perceiving their spending as part of a wider luxury lifestyle trip. Luxury brands understand this well and invest heavily in Japan-specific marketing campaigns, store designs, and exclusive items that cannot be found elsewhere, increasing the country’s pull as a retail destination.

From a macro perspective, Japan’s success in positioning itself as a luxury shopping hub also has ripple effects on the global branded goods market. With inbound shopping accounting for billions of dollars in annual sales, major brands use Japan as a test bed for Asia-focused product launches and consumer engagement strategies. The insights gathered from Japan’s tourist shoppers often shape regional pricing strategies, product lines, and even store layouts in nearby markets. This means the influence of Japan’s retail ecosystem stretches far beyond its borders, subtly shaping how luxury brands approach the broader Asian consumer.

As tourism rebounds strongly post-pandemic, Japan is doubling down on its status as a duty-free paradise for luxury shoppers. Government policies are increasingly supportive, with digital tax refund systems and promotions that tie in seamlessly with mobile payments and international e-commerce. Meanwhile, luxury brands continue to court both domestic and tourist customers with creative collaborations, exclusive merchandise, and concierge-level shopping services. This synergy between government, brands, and the tourism sector will likely keep Japan’s edge intact, even as other Asian shopping destinations try to compete on price.

In the end, whether branded goods in Japan are definitively cheaper than in other Asian countries depends on a mix of factors: the currency exchange rate, local tax policies, brand pricing strategies, and the broader shopping experience. But for the savvy consumer, the answer often tilts in Japan’s favor because the combination of tax-free shopping, trusted authenticity, exclusive products, and cultural shopping experience adds up to real value that goes beyond just the price tag. The high tourism numbers only amplify this advantage by creating a vibrant market where competitive pricing and constant innovation keep global shoppers coming back for more.

This unique interplay of favorable tax structures, massive tourism inflows, and an unmatched luxury shopping culture ensures that Japan will continue to be seen as a regional benchmark for affordable luxury shopping. As more travelers discover the benefits of shopping in Japan, this trend will likely encourage other Asian markets to rethink their own tax regimes, tourism incentives, and luxury retail strategies. For now, Japan’s winning formula sets it apart, making it not only a cultural gem but also a retail powerhouse in the world of branded goods.

How Indonesian jastippers are flocking to Japan due to the free visa and weak yen as Japan become the shopping paradise in recent time?

In recent years, Indonesia’s jastip community—short for jasa titip or personal shopping services—has turned its eyes toward Japan, creating a fascinating retail wave driven by the perfect blend of visa-free travel, a historically weak yen, and Japan’s enduring allure as a shopping paradise. What once required intricate planning and hefty budgets is now an accessible business opportunity for thousands of Indonesians who see Japan not just as a tourist destination but as a lucrative marketplace where trusted branded goods and exclusive items are ripe for the picking. The ease of entry has significantly lowered barriers for micro-entrepreneurs, with Japan’s free visa for Indonesian passport holders simplifying the logistics of multiple trips a year. This seamless travel arrangement has energized the jastip ecosystem, allowing even small-scale buyers to operate efficiently, source items directly, and serve a market back home that craves authenticity and exclusivity.

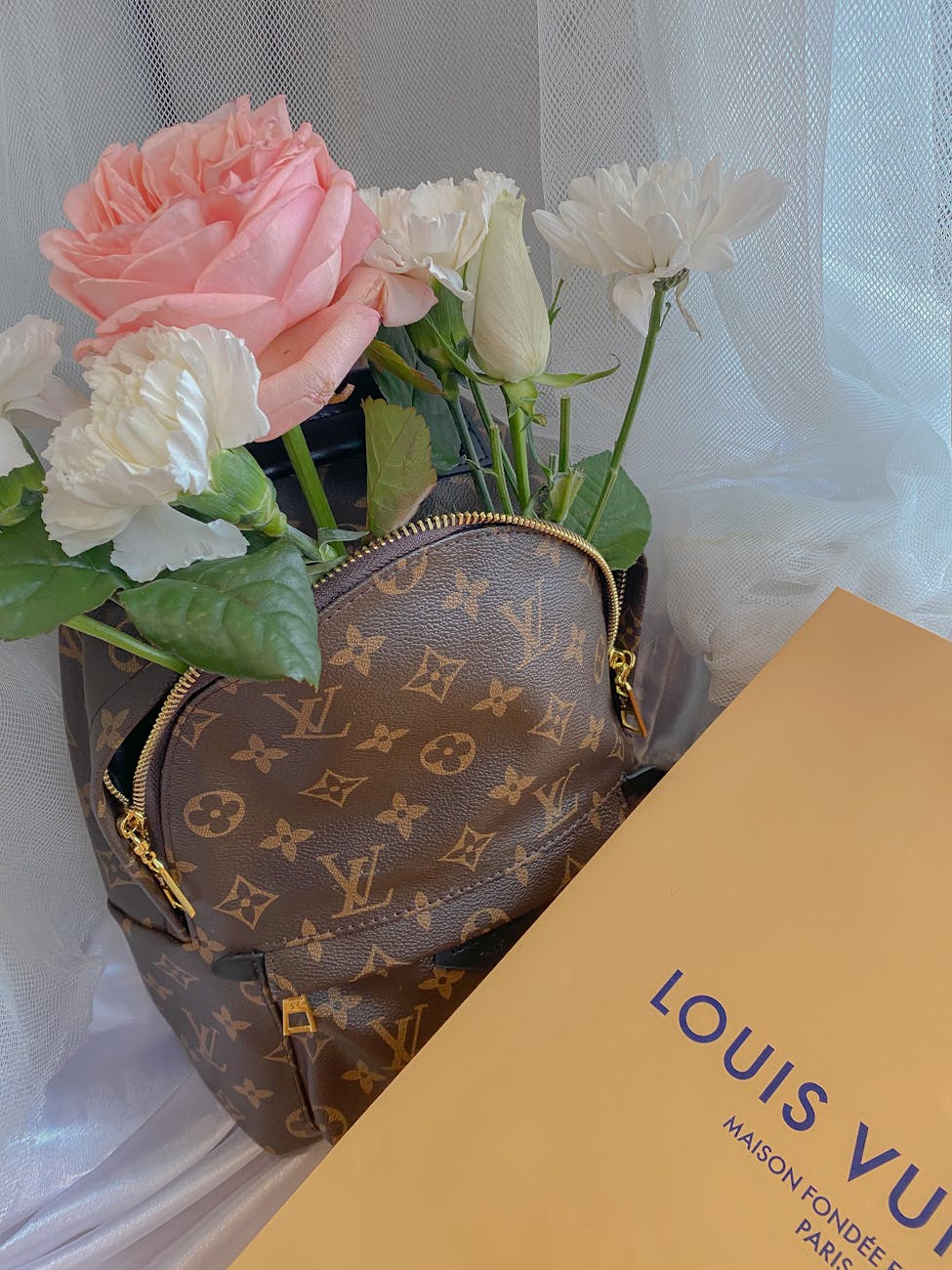

Currency dynamics play a powerful role in this trend, with the yen consistently weak against the Indonesian rupiah and the US dollar over the past several years. For jastippers, this translates to immediate cost advantages on globally coveted brands like Uniqlo, Muji, Onitsuka Tiger, and luxury labels such as Louis Vuitton, Chanel, and Dior that tend to run exclusive collections in Japan or unique region-specific stock that is hard to find elsewhere in Asia. The perception of Japan as a hub for authentic goods is another draw. In an era where counterfeit concerns plague Southeast Asian luxury markets, Indonesian buyers feel more secure sourcing directly from reputable Japanese department stores, flagship boutiques in Ginza, or even curated outlet villages like Gotemba. This confidence in authenticity elevates the perceived value of goods when resold, boosting profit margins for jastippers who position themselves as trustworthy intermediaries.

Japan’s retail environment has responded adeptly to this growing influx of foreign micro-shoppers, making shopping experiences even more jastip-friendly. Large department stores and luxury boutiques have embraced international customers with multilingual staff, duty-free counters, and streamlined tax refund systems that minimize checkout friction. Many shopping districts now cater specifically to tourists, bundling in services like free Wi-Fi, international shipping assistance, and packaging that enhances resale appeal back home. For Indonesian shoppers, these conveniences turn each trip into a highly organized sourcing mission, where they can stock up on high-demand items like limited-edition sneakers, designer handbags, beauty products, and Japanese lifestyle goods that have gained cult-like status across Southeast Asia.

The rise of social commerce platforms like Instagram and WhatsApp has further fueled this trend, giving jastippers direct access to Indonesia’s massive online consumer base hungry for Japan-exclusive products. Through these channels, small operators can post real-time shopping stories, take custom orders, and build trust by showing receipts and store visits. Many of these micro-businesses now function like agile pop-up stores, tapping into flash sales and store openings that create a sense of urgency and excitement for buyers back home. In doing so, Indonesian jastippers have effectively turned Japan’s thriving retail landscape into a virtual showroom for millions of middle-class consumers eager to access brands that feel just out of reach locally.

This micro-import boom holds larger implications for Indonesia’s e-commerce and informal retail markets, which have grown exponentially in the past decade. The country’s e-commerce sector is projected to surpass \$90 billion by 2025, and the informal jastip community is an agile piece of this puzzle. What’s remarkable is that these shoppers operate on lean logistics models—travel, buy, pack smartly, and fly back without the traditional import chain complexities that formal retailers face. Many consolidate orders to stay within luggage allowances and avoid hefty import duties, passing on these savings to buyers. The result is a resilient parallel economy that fills gaps in Indonesia’s retail ecosystem, particularly for aspirational goods that might otherwise be inaccessible due to local markups and limited stock.

Japan’s policy choices and broader tourism strategy are also key to sustaining this trend. By extending free visa programs to ASEAN markets like Indonesia and continuing to promote Japan as a safe, convenient, and welcoming destination, the government fuels a steady pipeline of Southeast Asian shoppers. In 2024 alone, tourism from Indonesia to Japan rebounded to near-record levels, with shopping spending topping the list of travel priorities. Major Japanese retailers have noticed this surge, adapting store layouts and marketing campaigns to woo Southeast Asian customers with tailored promotions and Japan-only editions of popular products. Some brands have even collaborated with Indonesian influencers to build buzz, knowing that social media amplification by jastippers creates viral demand back home.

While the phenomenon brings clear economic benefits for Japan’s retail sector, it also impacts the global branded goods market, subtly shifting how brands plan regional launches and inventory allocation. The high turnover from Southeast Asian micro-shoppers encourages luxury labels to roll out more limited runs and Japan-exclusive collections, which in turn reinforce the perception that Japan is the ultimate hunting ground for rare finds. This exclusivity loop drives up travel demand, encourages repeat trips, and keeps Japan a step ahead of other Asian shopping destinations like Singapore, Hong Kong, or South Korea, which face stiffer competition for the same jastip dollars.

Yet this booming cross-border micro-commerce trend does not come without challenges. For jastippers, staying under customs radar while managing escalating luggage loads and tighter airline baggage rules requires savvy strategy and meticulous planning. Some have turned to third-party shipping partners and group buying models to split loads across multiple travelers, blurring the lines between personal shopping and informal importing. As Indonesia’s customs regulations tighten and digital monitoring improves, the community may face greater scrutiny, but the resilience of this informal sector suggests it will adapt in innovative ways.

Looking ahead, the jastip phenomenon is likely to expand further as travel becomes more affordable and digital tools make sourcing and selling even more efficient. Tech-savvy young Indonesians see Japan as a gateway for entrepreneurship, combining wanderlust with profit-driven missions that help them earn extra income or even build sustainable businesses. Some larger jastip operators have evolved into well-known brands themselves, with loyal customer bases that treat them like trusted curators for the latest drops from Tokyo, Osaka, or Kyoto. This reflects a broader generational shift where consumers prefer direct, personal channels for global shopping over impersonal big-box e-commerce sites.

Japan’s ability to maintain its status as the shopping paradise of choice will rest on its continued commitment to tourism-friendly policies, its vibrant retail offerings, and its cultural appeal that makes every trip feel like more than just a shopping spree. As long as the yen remains weak and the visa-free policy holds, Indonesian jastippers will keep flocking to Japan, fueling a micro-economy that connects the two countries in an ever-evolving loop of trade, travel, and trust. For brands, this presents opportunities and challenges alike—how to manage supply and pricing while tapping into this grassroots demand channel that shows no sign of slowing down.

In the end, the Indonesian jastip boom in Japan is more than just a story of shopping bags and suitcases stuffed with goods. It is a testament to the ingenuity of a new generation of micro-entrepreneurs who are reshaping regional retail, forging connections across borders, and redefining what it means to shop in a globalized, hyper-connected world. With every round-trip ticket to Narita or Kansai, these modern treasure hunters keep proving that where opportunity and access converge, markets will flourish in the most unexpected yet fascinating ways.

What jastippers need to know when return back to Indonesia to avoid the goods been confiscated or getting high import tax while hand carrying it?

For thousands of Indonesians who make a living or side income as jastippers—trusted personal shoppers who fly abroad to buy goods on behalf of eager local buyers—the thrill of a successful shopping trip can quickly turn stressful if they don’t understand how to handle customs regulations on their return to Indonesia. As the jastip trend grows bigger, especially with shopping trips to Japan, South Korea, and Europe, many newcomers underestimate how strict customs can be when it comes to high-value or bulk items carried in personal luggage. The first thing every jastipper must grasp is that Indonesia’s customs office considers all goods brought back—whether for personal use or resale—as potentially taxable imports, and the burden of proof is always on the traveler. This means that having receipts, clear declarations, and an honest approach is critical to avoid penalties, confiscation, or unexpected duties that can eat into already slim profit margins.

One of the biggest mistakes novice jastippers make is to assume that just because they are hand-carrying the goods, they are automatically safe from import taxes. In reality, Indonesia’s customs law applies to all goods regardless of how they arrive—by air freight, courier, or in your suitcase. There is a clear de minimis threshold that travelers should know: for personal hand-carried goods, the limit is about USD 500 per passenger. This means that if your total declared value of goods exceeds this threshold, you are required to pay import duty, VAT, and possibly luxury tax for branded items like designer bags, watches, or limited-edition sneakers. Many Indonesian shoppers traveling to Japan or Europe think that splitting the load among multiple people will guarantee safety. While this is common, customs officers are trained to spot suspicious patterns, such as multiple travelers on the same booking with identical bags filled with the same items. It’s wise for jastippers to understand that repeated trips with large quantities of similar goods can put them on customs’ radar.

The challenge is that Indonesian customs has stepped up its digital and on-the-ground surveillance, often collaborating with airlines and even checking social media. Popular jastip operators who flaunt their hauls online may not realize that customs officers do their research too. This new scrutiny means it’s more important than ever to have proper documentation. Keeping original store receipts and being ready to show proof of purchase helps customs determine fair valuation. Underreporting value or hiding goods could result in fines, confiscation, or worse, a ban on reentry as a trusted traveler. For high-ticket luxury items, receipts can also help you argue for more accurate tax calculations, instead of facing arbitrary valuation which might be higher than what you actually paid—especially if you scored the item during a flash sale or special discount overseas.

Another critical point that many jastippers overlook is the type of goods they bring. Indonesia has clear rules about restricted and prohibited items. For example, health supplements, cosmetics, and food products can fall under stricter checks because they may require BPOM permits. Trying to sneak in 50 bottles of popular Japanese vitamins, no matter how small, can quickly become a customs nightmare. Electronics like smartphones or tablets are also under the spotlight since they must be registered with IMEI numbers for them to be usable in Indonesia. Smart jastippers plan ahead by avoiding banned goods or learning how to get proper permits if they want to expand into regulated categories.

The rise of jastip micro-entrepreneurs is reshaping how Indonesians access global branded goods, but this vibrant informal trade also means customs authorities are under pressure to close loopholes. To balance opportunity with compliance, savvy jastippers develop clear strategies. One popular approach is to diversify product types and price points instead of focusing on bulk quantities of a single high-value item, which can immediately draw suspicion. Combining personal-use items with jastip orders can also help keep declared values closer to the threshold. Packing smartly matters too: putting everything in its original packaging, with tags and receipts, helps establish that the goods are indeed new and for resale, instead of suspiciously hidden in used clothes or disguised as old items.

It’s not just the goods themselves—how you declare them is equally important. At the Indonesian airport, always choose the red channel if you know you exceed the personal allowance. Trying your luck in the green channel and getting stopped can lead to bigger penalties than being upfront. Many seasoned jastippers now factor these costs into their pricing for customers back home, positioning themselves as trustworthy sellers who follow the rules and still deliver authentic goods at competitive prices. Some even include customs taxes in their final service fees, giving buyers peace of mind that they won’t face surprise fees if their package is checked again during last-mile delivery.

Beyond the personal risk, there’s the broader market impact to consider. Indonesia’s informal jastip economy is significant; some estimates suggest that jastip-driven shopping accounts for millions of dollars in spending each year in destinations like Japan, South Korea, and Europe. This demand helps boost global sales for big brands while also bypassing traditional retail and distributor channels. As this parallel economy grows, it inevitably draws closer regulatory attention, with the Indonesian government looking for ways to ensure fair taxation without stifling entrepreneurial spirit. More digital tracking, smart customs scanning, and better regional cooperation mean the days of slipping through with dozens of luxury handbags stuffed into one suitcase are numbered.

It’s also wise for jastippers to stay informed on policy changes. Customs rules are evolving rapidly, especially with the government’s push to increase non-tax revenue and curb illegal imports. Joining communities, reading up on official guidance, and even consulting professional shipping or tax advisors can be worthwhile investments for jastippers planning to scale up. Larger operators sometimes move from hand-carrying to working with trusted forwarders or micro-logistics partners who can handle bigger shipments more safely through proper channels. This approach may cut into margins but brings peace of mind, allowing jastippers to grow from hobby shoppers to serious cross-border resellers.

Ultimately, what keeps the jastip model thriving is the trust that Indonesian buyers place in these travelers. Customers want authentic, exclusive goods, and they also want the reassurance that their orders won’t get held up or cost extra due to unpaid duties. By doing things right—declaring honestly, knowing the thresholds, having the receipts, avoiding banned products, and working with compliant shipping partners when needed—jastippers can protect that trust and build sustainable, repeat business. It’s about striking a smart balance between profit and compliance in a landscape that is becoming more digital, more regulated, and more competitive every year.

For the global market, this means Indonesian spending power will keep flowing overseas, fueling demand for unique products and limited editions that big brands love to test in vibrant retail hubs like Japan, South Korea, and Europe. As long as jastippers understand the import rules, declare wisely, and manage risk, this creative model of micro-importing will remain a powerful force that shapes cross-border consumer behavior and keeps the spirit of personal shopping alive in the digital age. By staying informed and adaptable, today’s jastippers are not just travelers with extra bags—they are a new generation of small-business operators driving billions in global retail, one suitcase at a time.