Indonesian resellers in recent years have discovered a goldmine of opportunity in sourcing luxury brands from Japan to serve the fast-growing domestic demand for premium fashion, accessories, and lifestyle products. Japan’s luxury market, valued at over USD 26 billion annually, is one of the most refined in the world, blending global luxury houses like Louis Vuitton, Chanel, and Hermès with unique homegrown brands such as Issey Miyake, Comme des Garçons, and Visvim. For Indonesian consumers—especially millennials and Gen Z with increasing disposable income—Japanese-sourced luxury goods carry not just the allure of exclusivity but also a story of quality, craftsmanship, and rarity. The appetite for luxury in Indonesia has been expanding at an annual growth rate of 8–10%, outpacing many other Southeast Asian markets, and resellers are positioning themselves as the perfect bridge between Japan’s retail sophistication and Indonesia’s booming consumer class.

One of the reasons Japanese-sourced luxury goods resonate so well in Indonesia is the unique product availability and market pricing differences that make reselling profitable. Japanese boutiques, department stores, and outlet malls often have exclusive colorways, limited editions, and seasonal collaborations that never make it to Southeast Asian retail shelves. Brands like BAPE, Porter Yoshida, and Wacko Maria frequently release small-batch collections that become instant status symbols among trend-savvy buyers in Jakarta, Surabaya, and Bali. Even global brands such as Rolex, Cartier, and Dior sometimes offer Japan-exclusive stock or better pricing due to currency exchange advantages and Japan’s competitive luxury retail environment. Indonesian resellers leverage this gap to offer rare, in-demand items at a healthy margin while still undercutting the price of local official retail stores, making them highly attractive to discerning shoppers.

The logistics and cross-border e-commerce infrastructure connecting Japan to Indonesia has never been stronger, enabling these resellers to operate with unprecedented efficiency. Advancements in air cargo, consolidated shipping, and tax optimization through transit hubs like Singapore and Batam allow resellers to shorten lead times from weeks to just a few days, meeting the instant-gratification demands of today’s luxury consumer. Platforms such as Instagram, TikTok Shop, and WhatsApp Commerce have become powerful sales channels, where a reseller can post a product from a Tokyo boutique in the morning and close multiple sales in Indonesia by the evening. This direct-to-consumer, high-speed model bypasses the sluggish pace of traditional distribution networks, enabling smaller players to compete with major luxury retailers.

Japanese culture’s meticulous approach to product care also adds an advantage for resellers, especially in the pre-owned luxury segment. The Japanese secondhand market, valued at over USD 20 billion, is one of the largest and most trustworthy in the world, with pristine items, official authentication, and detailed maintenance records. This allows Indonesian resellers to confidently offer pre-owned Rolex watches, Hermès bags, or Chanel jackets in near-mint condition, appealing to customers who want luxury at a more accessible entry price. The global luxury resale market itself has been growing at over 15% annually, and in Indonesia, this trend has accelerated thanks to increased consumer awareness of sustainability and the “buy better, buy less” movement.

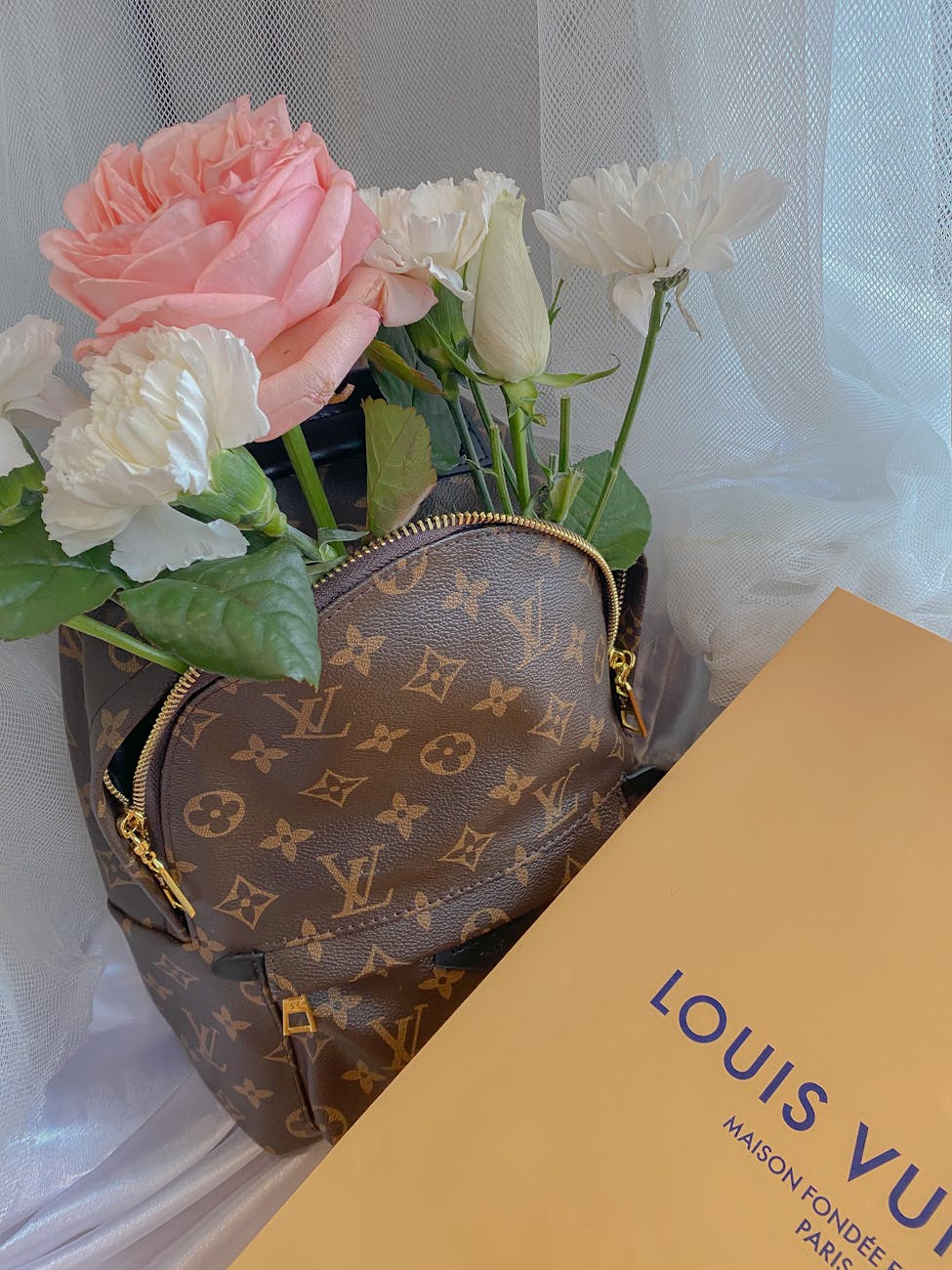

The social media factor cannot be overstated in driving this cross-border luxury flow. Indonesian influencers, celebrities, and stylists frequently showcase Japanese-sourced luxury goods, setting off micro-trends that spike demand almost overnight. For instance, when a Jakarta-based fashion influencer debuted a Japan-exclusive Louis Vuitton bag on Instagram, several resellers reported selling out their entire stock within 48 hours. The same happens with sneaker culture, where limited releases from Nike Japan or Asics collaborations trigger instant sell-outs among Indonesian sneakerheads. Social validation and fear of missing out are powerful motivators in the luxury sector, and resellers who can anticipate these trends often capture the lion’s share of the market.

From a technical standpoint, the profit model for Indonesian resellers importing from Japan hinges on careful cost management and currency strategy. With the yen at historic lows against the rupiah, purchasing power for Indonesian buyers is amplified, allowing resellers to secure goods at favorable rates. Shipping consolidation reduces per-unit freight costs, while smart customs classification can help optimize import tax exposure. Some resellers even use pre-order systems where customers pay in advance, effectively removing inventory risk and ensuring guaranteed sales before procurement. This lean operating model means even small-scale resellers can scale quickly without massive capital outlay, making the market accessible to a new wave of entrepreneurs.

The consumer profile in Indonesia is shifting toward younger, more globally connected buyers who are highly responsive to global fashion cycles. Millennials and Gen Z account for more than 60% of luxury purchases in Indonesia, a figure projected to grow as this demographic’s spending power rises. This group values authenticity, rarity, and brand heritage—qualities that Japanese-sourced luxury products deliver in abundance. Furthermore, as Indonesia’s e-commerce penetration deepens, luxury buying behavior is moving online, removing the traditional stigma of purchasing high-ticket items outside official brand boutiques. Resellers who invest in digital trust—through secure payment methods, transparent authentication, and responsive after-sales service—are building loyal repeat customers in this lucrative segment.

Events like the Tokyo Fashion Week and exclusive pop-up stores from brands such as Gucci Vault or Dior Café in Japan further fuel the desirability of Japanese-sourced goods in Indonesia. Resellers who physically attend these events can secure pieces before they reach global hype status, positioning themselves as gatekeepers of cutting-edge luxury. This early-access advantage creates both scarcity and urgency in the Indonesian market, allowing resellers to set premium pricing and cultivate a brand image as tastemakers rather than mere middlemen. The storytelling aspect—sharing the origin, exclusivity, and journey of each item—enhances perceived value and strengthens customer connection.

Looking ahead, the synergy between Japan’s luxury ecosystem and Indonesia’s consumption boom presents enormous growth potential. Indonesia’s luxury market is forecast to surpass USD 3.5 billion in sales within the next five years, and the ability of resellers to tap into Japan’s supply chain ensures they can meet the evolving demands of an increasingly sophisticated customer base. Technological innovations like AI-driven trend forecasting, blockchain authentication for high-value items, and real-time currency exchange optimization will further streamline operations for cross-border resellers. In the long term, partnerships between Indonesian resellers and Japanese department stores, auction houses, or luxury aggregators could formalize the trade and unlock even greater scalability.

In conclusion, Indonesian resellers are uniquely positioned to explore and profit from Japan’s luxury market thanks to favorable currency dynamics, superior product availability, trusted secondhand channels, and cutting-edge cross-border logistics. They serve not only as importers of physical goods but also as curators of global style, delivering exclusivity and cultural capital to a market hungry for both. As luxury consumption in Indonesia continues to evolve, those who master the art of sourcing from Japan will not just ride the trend—they will help define it, shaping consumer preferences and strengthening Indonesia’s role as one of Southeast Asia’s most dynamic luxury markets.

How secondhand luxury goods in Japan become popular with Indonesian consumer?

Secondhand luxury goods from Japan have captured the attention of Indonesian consumers in recent years, transforming from a niche curiosity into a mainstream buying trend. Japan’s secondhand luxury market, valued at over USD 20 billion annually, is among the most trusted and organized in the world, built on a culture of meticulous care for possessions and a rigorous authentication process that ensures goods are genuine and well-maintained. For Indonesian buyers, who are becoming increasingly sophisticated and brand-conscious, this combination of authenticity, quality, and value creates a compelling proposition. The Indonesian luxury market itself is growing at an annual rate of 8–10%, with an expanding segment of consumers actively seeking premium products at accessible price points, making secondhand goods from Japan a perfect fit.

One of the primary drivers behind the popularity of Japanese pre-owned luxury goods in Indonesia is the exceptional condition of the products available. Japanese consumers are known for maintaining their luxury items—be it a Chanel handbag, a Rolex watch, or a Louis Vuitton wallet—in near-perfect condition, often accompanied by original receipts, packaging, and care documentation. This not only enhances the resale value but also gives Indonesian buyers confidence in their purchases, especially in a market where counterfeit goods remain a persistent concern. Many Indonesian consumers view Japan as a gold standard for secondhand luxury, associating it with transparency, reliability, and high resale potential should they choose to trade the item again in the future.

The appeal is also heavily tied to price competitiveness and unique availability. Due to currency fluctuations, especially the yen’s recent weakness against the Indonesian rupiah, Japanese secondhand goods often cost significantly less than their equivalents in Indonesia’s official retail channels, even after factoring in shipping and import costs. On top of that, Japan’s resale market often offers limited editions, discontinued models, and rare colorways from brands like Hermès, Dior, or Cartier that never made it to Indonesian boutiques. This creates an exclusivity factor, allowing Indonesian consumers to own luxury pieces that stand out from mainstream releases and signal individuality in a market that highly values social prestige.

Technology and cross-border e-commerce platforms have played a vital role in making this trend more accessible. Advancements in online authentication, blockchain-based product verification, and trusted cross-border payment gateways have eliminated much of the risk once associated with buying luxury goods internationally, enabling Indonesian consumers to shop confidently from Japanese stores and resellers without traveling abroad. Instagram storefronts, TikTok live-selling, and specialized resale platforms like Brand Off, Komehyo, and RAGTAG have become major gateways for Indonesian shoppers, where products can be showcased in real time with close-up condition checks and immediate purchase options. The digital-first approach also allows resellers to close transactions within hours of posting a rare item, reducing inventory risk and maximizing speed to market.

The social and cultural dimension adds another layer to the phenomenon. Indonesian celebrities, influencers, and stylists increasingly feature Japanese-sourced secondhand luxury goods in their content, normalizing pre-owned purchases as a smart and fashionable choice rather than a compromise. A Jakarta-based style influencer carrying a vintage Hermès Kelly from a Tokyo boutique can spark a wave of demand, with multiple resellers competing to secure similar stock. This trend aligns with global shifts in consumer behavior, where buying pre-owned is seen as part of sustainable fashion and conscious consumption. For Indonesia’s younger buyers, particularly millennials and Gen Z, the appeal lies not only in price savings but also in the story and heritage behind each item—qualities that align with Japan’s deep respect for craftsmanship and detail.

From a business perspective, the mechanics of importing Japanese secondhand luxury into Indonesia have become increasingly efficient. The rise of shipping consolidation hubs, particularly through Singapore and Batam, has reduced lead times from weeks to just days while optimizing import tax exposure, making it feasible for smaller resellers to compete with established luxury retailers. Many operate on a pre-order model, securing payment before sourcing the item, which minimizes capital outlay and eliminates the risk of unsold inventory. In some cases, Indonesian resellers even form partnerships with Japanese auction houses or consignment stores, ensuring a steady flow of high-quality goods at predictable prices. This lean supply chain approach allows for healthier margins while keeping prices attractive to buyers.

Market data shows that the luxury resale segment globally is growing at more than 15% per year, and Indonesia is emerging as one of Southeast Asia’s most promising growth markets for pre-owned luxury. The combination of a young, digitally savvy consumer base and rising household incomes creates fertile ground for expansion. In urban centers like Jakarta, Surabaya, and Bali, where luxury consumption is a visible part of social life, secondhand purchases enable more consumers to participate in the luxury economy without the barrier of full retail pricing. Additionally, because many of these Japanese-sourced goods retain or even appreciate in value—such as rare Rolex models or limited-run Louis Vuitton collaborations—they are seen as both fashion statements and investment assets.

There is also a psychological aspect to the success of Japanese secondhand goods in Indonesia. Owning a rare or vintage piece from a respected Japanese store carries a level of prestige, as it suggests both global exposure and insider knowledge of luxury markets. This feeds into the aspirational lifestyle marketing that dominates social media in Indonesia, where buyers are eager to showcase unique, conversation-starting items. Resellers capitalize on this by not just selling products but also curating experiences—sharing photos of sourcing trips in Tokyo’s Ginza or Osaka’s Shinsaibashi, documenting visits to iconic stores, and telling the story behind each acquisition. This narrative-driven approach increases perceived value and strengthens customer loyalty.

Recent economic factors have further fueled demand. With overseas travel still relatively expensive for many Indonesians, shopping directly in Japan is not always feasible, but buying through trusted resellers provides the same access without the added cost of flights, hotels, and travel expenses. The weak yen has amplified this advantage, allowing Indonesian buyers to acquire luxury goods at historically favorable exchange rates. Many resellers are quick to highlight this in their marketing, positioning now as “the best time to buy” before currency conditions change, effectively creating urgency in the marketplace.

Looking ahead, the popularity of Japanese secondhand luxury goods in Indonesia is unlikely to slow down. The trend is supported by strong fundamentals: a growing luxury consumer base, cultural trust in Japanese quality, expanding e-commerce reach, and the global shift toward sustainable consumption. Technological advancements in authentication and logistics will only make the process smoother, while evolving consumer attitudes will continue to normalize pre-owned purchases. If anything, the market may diversify further, moving beyond handbags and watches into categories like high-end jewelry, collectible sneakers, and even luxury homeware from Japanese brands.

In conclusion, the rise of Japanese secondhand luxury goods among Indonesian consumers is a product of perfect timing, cultural alignment, and market readiness. It combines Japan’s reputation for quality and authenticity with Indonesia’s hunger for luxury and exclusivity, all facilitated by digital commerce and streamlined cross-border logistics. What began as a niche for fashion insiders has now become a mainstream shopping habit, reshaping the luxury landscape in Indonesia and offering both buyers and resellers a wealth of opportunity. Those who can adapt quickly, build trust, and maintain a pulse on Japanese market releases will not just ride this trend—they will help define the next chapter of Southeast Asia’s luxury economy.

How Japan become the heaven for luxury watch hunter worldwide?

Japan has earned a reputation as the ultimate destination for luxury watch hunters, attracting collectors, investors, and enthusiasts from every corner of the world. The Japanese luxury watch market is valued at billions of dollars annually and is supported by one of the most organized, transparent, and detail-oriented retail ecosystems globally, offering both brand-new timepieces and an extensive secondhand market that is unmatched in reliability. For those seeking iconic brands such as Rolex, Patek Philippe, Audemars Piguet, or Omega, Japan is not just a place to shop—it is a curated treasure chest where rare models, immaculate pre-owned pieces, and even discontinued editions are available in pristine condition. This combination of variety, quality, and authenticity makes Japan a global magnet for serious watch hunters.

One of the reasons Japan stands out in the world of horology is its culture of meticulous care for possessions. Japanese owners are known for treating their watches with extraordinary respect, often keeping original boxes, papers, and service records intact, which significantly enhances the value and desirability of pre-owned models. This is particularly important in the luxury watch market, where provenance and condition play a critical role in determining a piece’s resale value. The secondhand watch market in Japan is not a shadow industry but a highly regulated and respected part of the retail landscape, supported by specialist stores, auction houses, and certified dealers that follow strict authentication procedures. For international buyers, this translates into peace of mind and confidence in every purchase.

Price competitiveness is another major draw. Currency fluctuations, particularly the yen’s recent weakness, have made Japan an even more attractive destination for buying luxury watches, with many models priced significantly lower than in other major markets even before considering tax refund benefits for tourists. This pricing advantage applies not only to new releases but also to pre-owned and vintage pieces, where Japanese market dynamics often keep margins slimmer than in other parts of the world. In addition, Japan frequently receives exclusive allocations from major Swiss brands, meaning certain dial variations, limited editions, or boutique-only models can be sourced here before they appear elsewhere, if they ever do.

The sheer variety available in Japan is staggering. Tokyo alone boasts districts such as Ginza and Shinjuku that are home to dozens of specialized watch boutiques and resellers within walking distance of each other, each offering an array of pieces from entry-level luxury to ultra-rare grail watches. Cities like Osaka, Nagoya, and Fukuoka also have vibrant watch scenes, with many local dealers catering to international buyers through bilingual staff and shipping options. For collectors, this concentration of supply means the ability to compare dozens of variations of a single model in person, something that is virtually impossible in most other countries. This hands-on access allows watch hunters to make informed decisions about details such as case condition, patina, bracelet stretch, and service history before committing to a purchase.

Japan’s deep watch culture also plays a significant role in its appeal. The country has its own proud watchmaking heritage, led by brands such as Grand Seiko, Credor, and Citizen, which are respected globally for their craftsmanship and innovation, often rivaling or even surpassing Swiss benchmarks in accuracy and finishing. Collectors who come for Swiss icons often leave with newfound appreciation for Japanese horology, adding pieces that combine world-class engineering with distinct Japanese aesthetics. The domestic market’s appreciation for both foreign and local brands means a rich mix of inventory, from steel sports watches like the Rolex Submariner to hand-finished Grand Seiko Spring Drive masterpieces.

The pre-owned and vintage segment in Japan is especially robust, driven by both domestic consumption patterns and a thriving export business. The global vintage watch market is growing at over 10% annually, and Japan has positioned itself as a key supply hub, offering everything from untouched Rolex GMT-Master “Pepsi” bezels to 1970s Omega Speedmasters in collector-grade condition. Unlike in many countries, where vintage watch shopping can feel like a gamble, Japanese dealers often understate the condition of their stock rather than oversell it, meaning buyers are pleasantly surprised when they inspect their purchases. This honesty, combined with transparent grading systems, has earned Japan a loyal international following.

E-commerce and social media have amplified Japan’s status as a luxury watch haven. Major Japanese watch retailers now list their stock online with detailed photographs, high-resolution condition reports, and global shipping options, allowing collectors in Europe, the Middle East, or Southeast Asia to browse and purchase with confidence. Instagram accounts, YouTube channels, and live-streamed watch auctions from Japan have become important trend drivers, often sparking global interest in specific models or references. For instance, when a rare Patek Philippe Nautilus in white gold appeared at a Tokyo boutique, it went viral among watch forums, and inquiries poured in from around the world within hours.

For many buyers, part of the allure is also the in-person experience. Shopping for watches in Japan is not just a transaction—it is a refined customer service journey, where knowledgeable staff take time to explain movement details, brand history, and maintenance tips. Even in the pre-owned space, dealers often provide after-sales support, including servicing through authorized channels. This commitment to long-term relationships rather than quick sales fosters trust and builds a strong base of repeat customers, both domestically and internationally. Watch hunting in Japan is often paired with travel, with enthusiasts timing their visits to coincide with major events like the Tokyo Watch Fair, where brands unveil exclusive releases and rare pieces are put on display.

From an investment perspective, Japan’s luxury watch market offers compelling opportunities. High-demand models such as the Rolex Daytona, Audemars Piguet Royal Oak, and Patek Philippe Aquanaut not only hold their value in Japan but often appreciate due to limited supply and growing global demand. Vintage models with unique dials or provenance can command significant premiums, especially when purchased in exceptional condition with full documentation—a hallmark of Japanese retail. For savvy buyers, sourcing in Japan and reselling in other markets can yield healthy margins, particularly when targeting regions where supply is constrained.

Recent economic conditions have further boosted Japan’s watch appeal. With international tourism rebounding and the yen’s position favorable for foreign currency holders, watch hunters from China, Southeast Asia, Europe, and the Middle East are flocking to Japan to take advantage of both inventory depth and pricing advantages. This influx has created a competitive environment where desirable pieces move quickly, encouraging buyers to act fast when they find the right watch. Dealers, in turn, are expanding their networks to source more stock, sometimes acquiring collections directly from Japanese consumers looking to upgrade or liquidate.

Looking ahead, Japan’s position as the heaven for luxury watch hunters seems secure. Its unique blend of cultural care for possessions, regulatory trust, deep inventory, competitive pricing, and passion for horology creates an ecosystem that few countries can replicate. As global interest in watches continues to grow, fueled by both the luxury goods market’s expansion and the rise of watches as alternative investments, Japan’s role will only become more significant. Whether one is seeking a mint-condition Rolex Submariner, a rare Grand Seiko Spring Drive, or a vintage Omega with perfect patina, Japan offers the thrill of the hunt paired with the reassurance of authenticity and quality. For collectors, investors, and enthusiasts alike, it remains not just a destination but a benchmark for what a luxury watch market should be.

Why should you ship with SindoShipping and how is our company able to help you and your business to ship your goods and products to Indonesia?

Our company vision is to help companies around the world to be able to export their products to Indonesia with ease and expand their market worldwide especially in South East Asia as Indonesia is the leading internet market and largest economy around the region and to help ease the process of importation to the country and we want to help millions of Indonesian to access products worldwide with effective shipping system.

With the proper documentation and brokerage, we are able to help our customers ship a few categories of goods which have limited restrictions to Indonesia without any hassle to the customers address directly as we understand the process and the regulation of the imports including the taxation process of imports.

SindoShipping specialized in electronics, high tech products, cosmetics, luxury branded, toys, supplement and vitamins, fashion, bags and shoes, and traditional medicine shipping to Indonesia since 2014 with the top accuracy of shipment service and the live tracking available during the cross border shipment so the customer can feel safe and secure about their shipping. Contact us now for further details at 6282144690546 and visit out site sindoshipping.com